Uranium at key accumulation zones

Dips are confirmed. Big moves are in our future later this year. FOMO now, not after it gets bid up!

Is it time to buy or buy more?

Lets take a look…

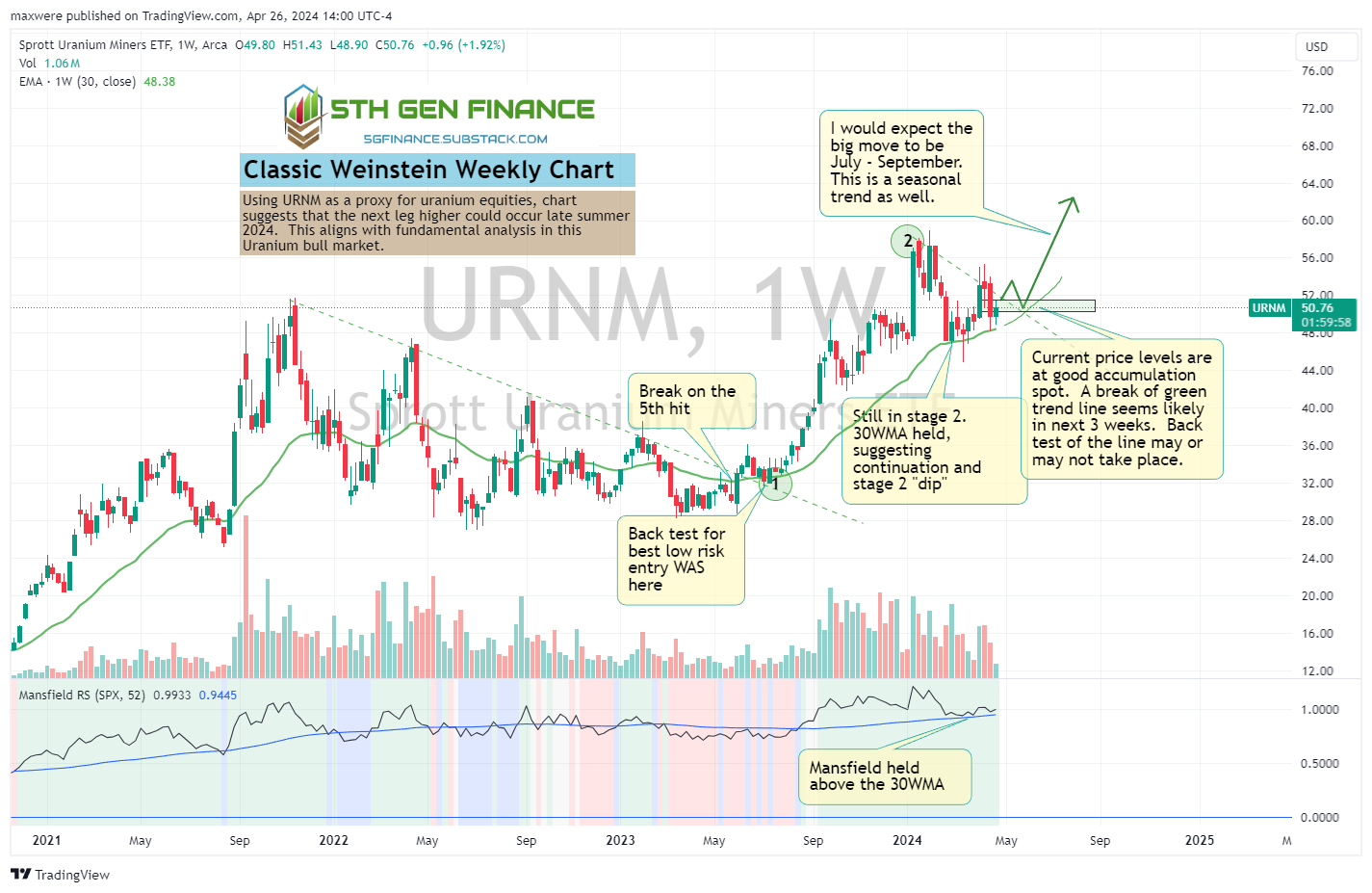

Today, I’m showcasing the classic Stan Weinstein technical setup on the weekly chart. Last week I wrote about stage analysis model. This week, URNM has a very clean chart in the classic stage analysis textbook layout.

Last July was the best risk adjusted entry for some time. Congratulations if you got these prices. Essentially best entry means, you got the price appreciation without having to wait out many months or years. The chart helped us identify that timing.

But year end, the market was smoking, up 80% from point 1. We got a douple top on the weekly with RSI reversal. This was a good indication it was time to cool off. Ask yourself, was this the top of the Uranium bull market? Were supply deficits appeased? Has the public gone mad with FOMO/YOLO investing? Does the market news cover the sector every day? If your answer is “No”, keep reading…

Green box: Now that RSI has returned to its baseline and retest of the 30 Week MA, timing seems close to another resumption move. The text book says 3rd or forth hit of the trend line breaks up and we possibly get a backtest around this URNM $50-52 area. But you never know. Buy the dip?

I think positioning in uranium equities is the play now. Lets look at its relationship to its primary market, the spot market.

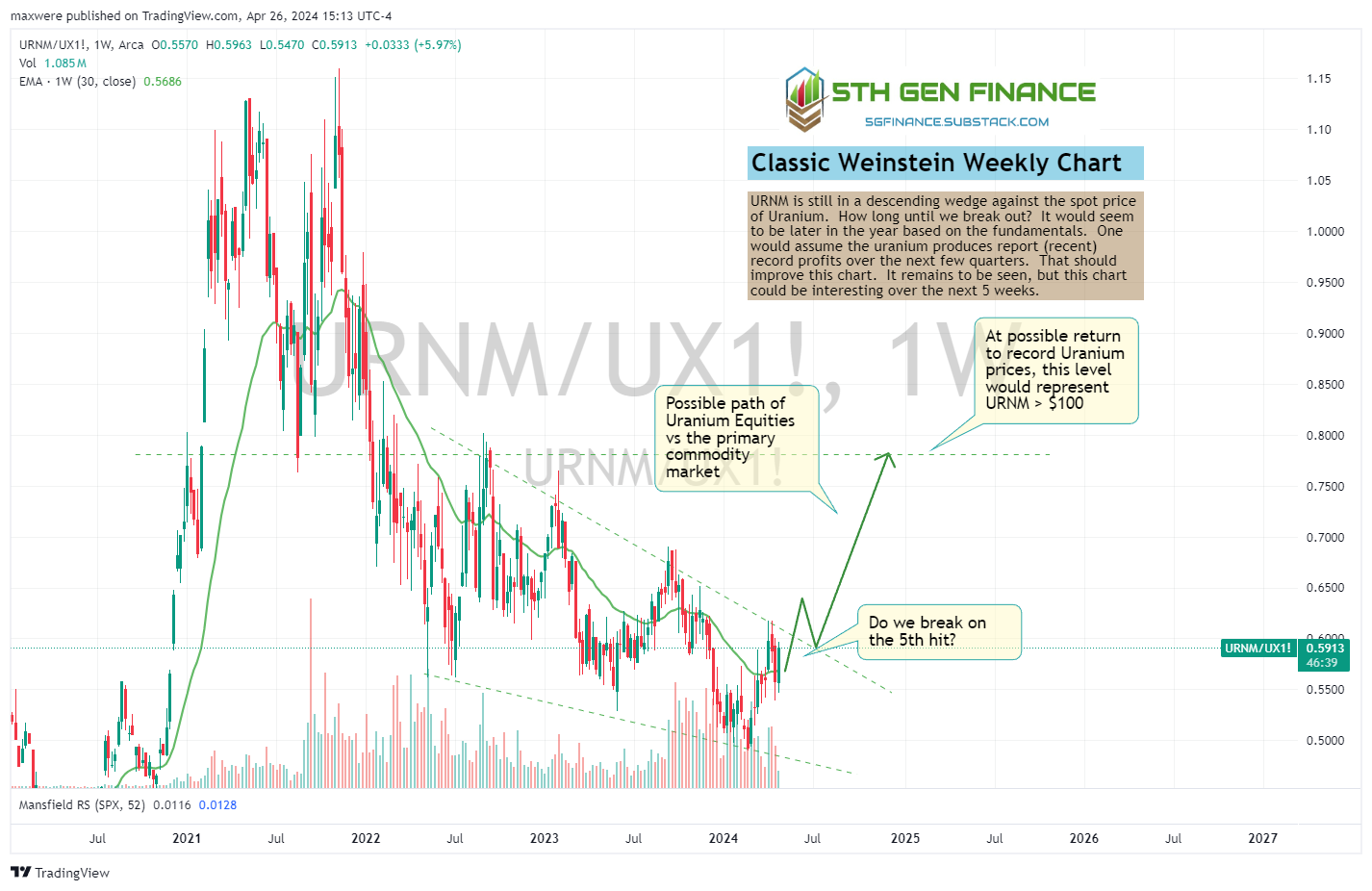

Spot Market Goes Dark

Most of the primary market makers are now in the term contracting space, not the spot market. That means, we have a much more difficult time forecasting miners since we don’t really have precise feel of their forward delivery price. Talk is that current contracting is happening in $75-80 range, but that is likely to continue to push upward. Other rumors suggest that an increasing part of these contracts are tied to an uncapped spot price. If true, this is a clear signal of a producers market (also water is wet). Sufice it to say, there isn’t a Uranium project in the world that isn’t profitable at current term pricing.

When will Uranium miners begin to reflect the spot market?

If you believe the spot market would have been the leaders of this bull market along with the large producers (CCJ and KAP), then the next group to make their move are the developers and near term players.

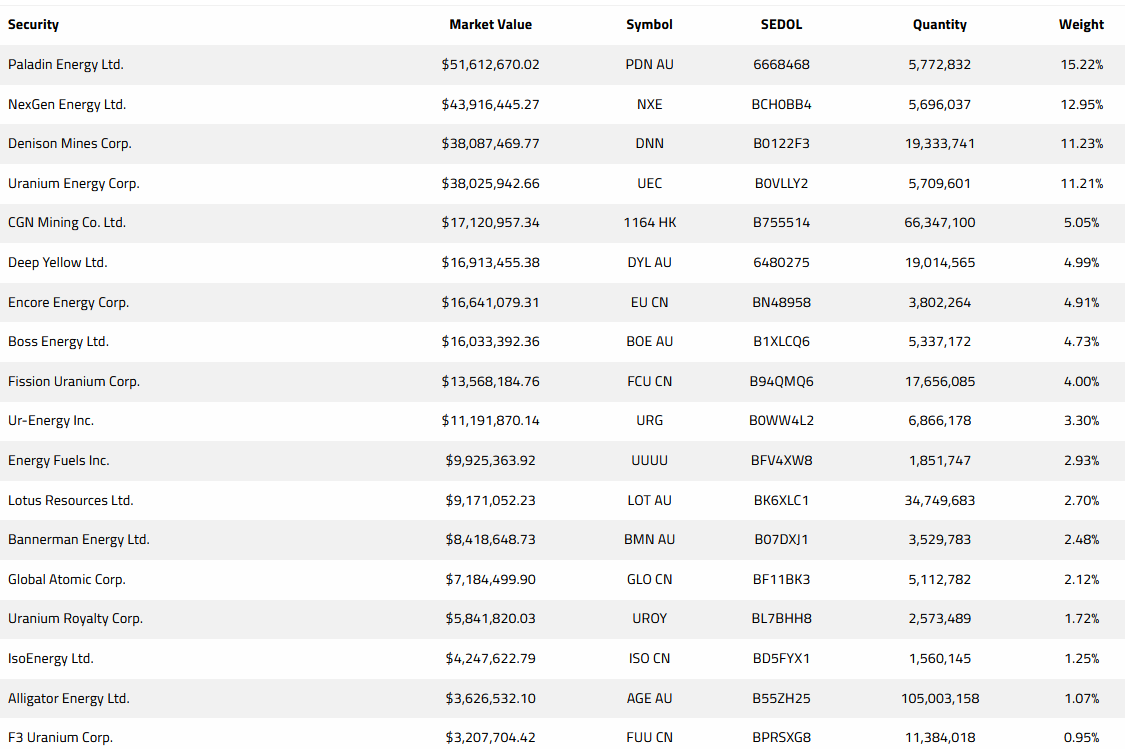

What are the beta plays?

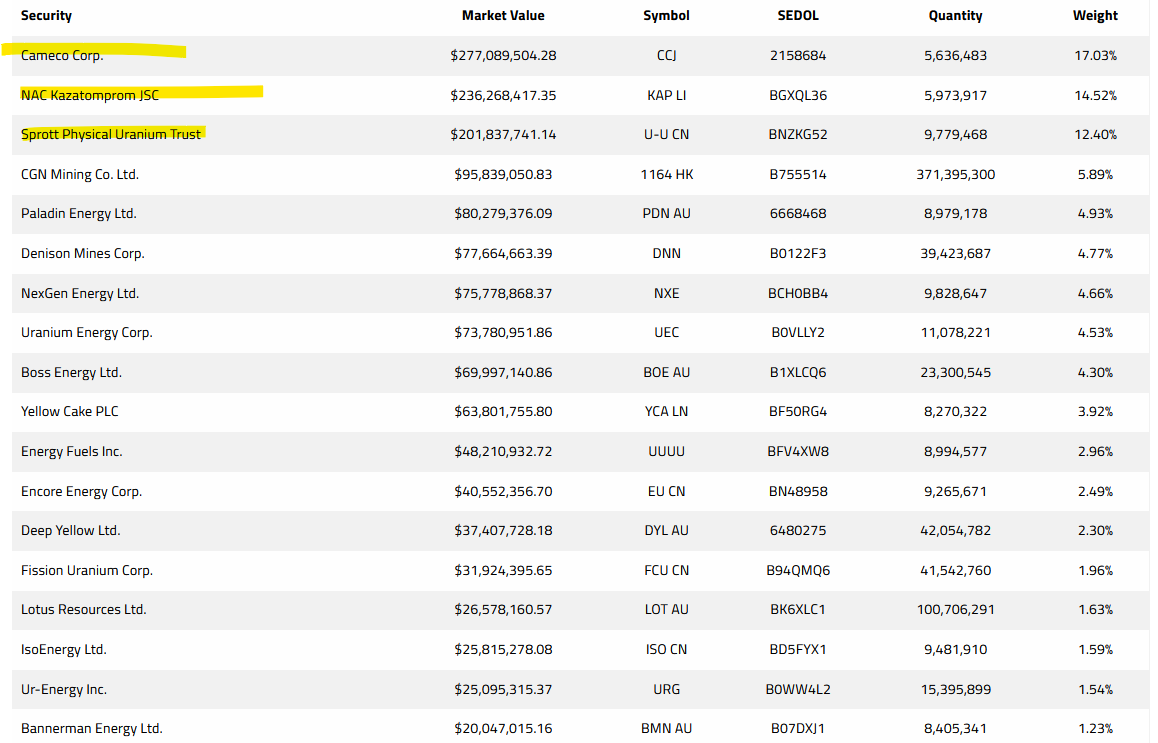

The decision between URNM and URNJ boils down to a question of whether you want U.UN (Sprott physical trust), KAP and CCJ in your exposure. Those 3 tickers are the top holdings in URNM. The balance of the fund is very similar to URNJ.

URNM is nearly 50% of the top 3 holdings…

These do not appear in the URNJ offering…

It boils down with how you want to balance your portfolio. I think the most upside is with URNJ (with possibly a lower floor).

Summary

DISCLAIMER: This is not investment advice. Speak to your financial planner to determine whats right for your financial outlook. This is merely my opinion of a plan.

Uranium and Uranium equities are highly volatile and likely shouldn’t realistically compose more than 10-25% of the average persons portfolio. Set your allocation percent and stick to it. If you are fully positioned, there isn’t anything to do here. If you are shopping for Uranium equities, this is a place to add those items on your list. I suspect we are still a few weeks away from big moves (an media noise), but its always the best time to enter positions when things are quiet.

Not an affiliate, but if you have or are considering more than about $20,000 invested in the uranium market, you probably find positive value to your future returns by becoming a Uranium Insider member: https://www.uraniuminsider.com/membership