Newmont misses, shorts go bananas

When does the worlds largest gold miner become attractive again?

Back in September I wrote the following piece on BTG 0.00%↑ breakout. This was an entry I did take, but what I forgot to mention how I redeployed that capital…

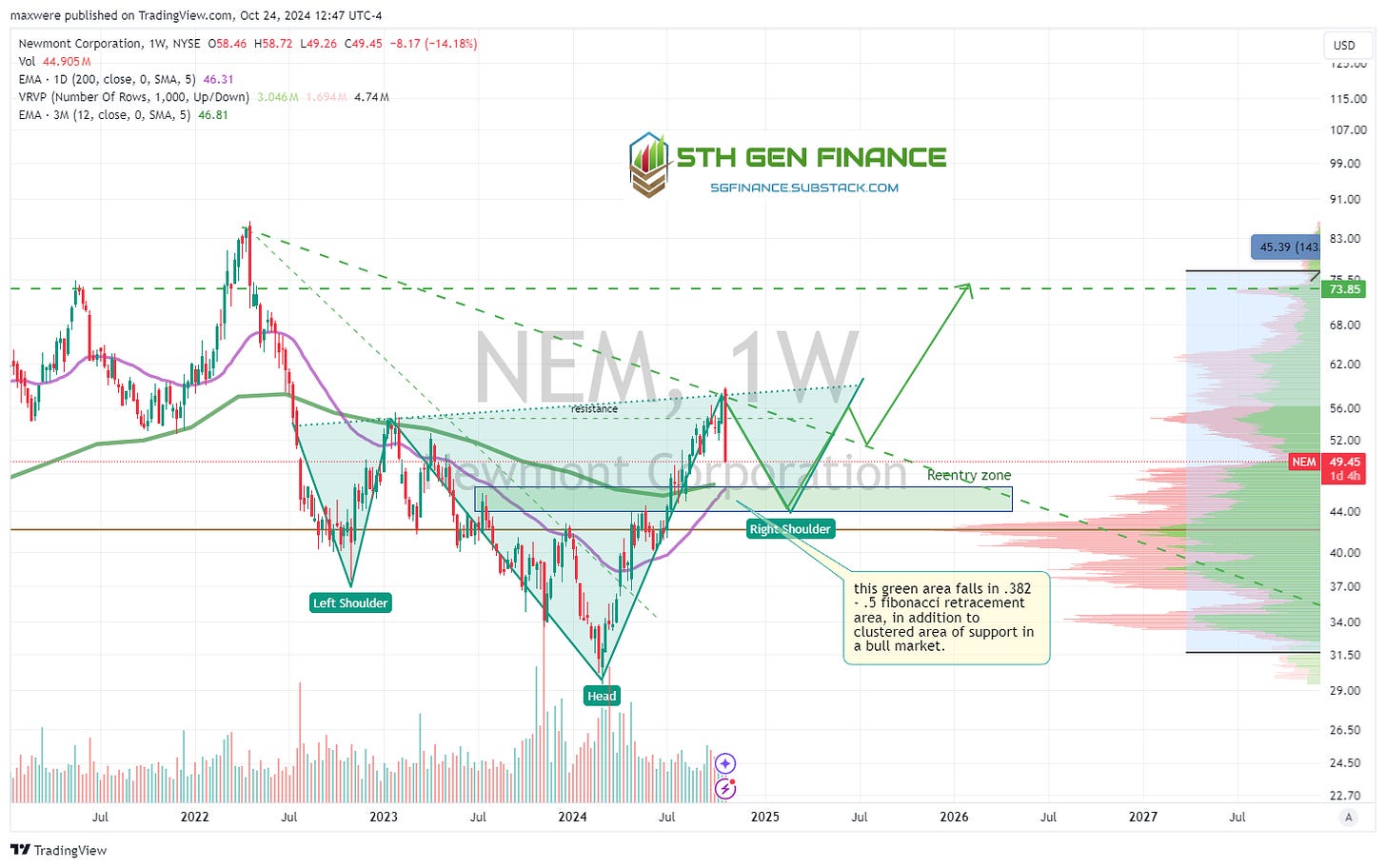

The Newmont chart at the time looked like this… I made a note to myself: sell NEM buy BTG:

Fast forward to today’s earnings call. Newmont reported higher costs to the tune of $150 per oz (to which they claim is temporary). They produce just under 7m oz per year (1b + difference), so naturally, the stock sold off 13b dollars as of this writing!

Why the firesale? Simple answer is the technical area of resistance turned a few weeks correction around in hours.

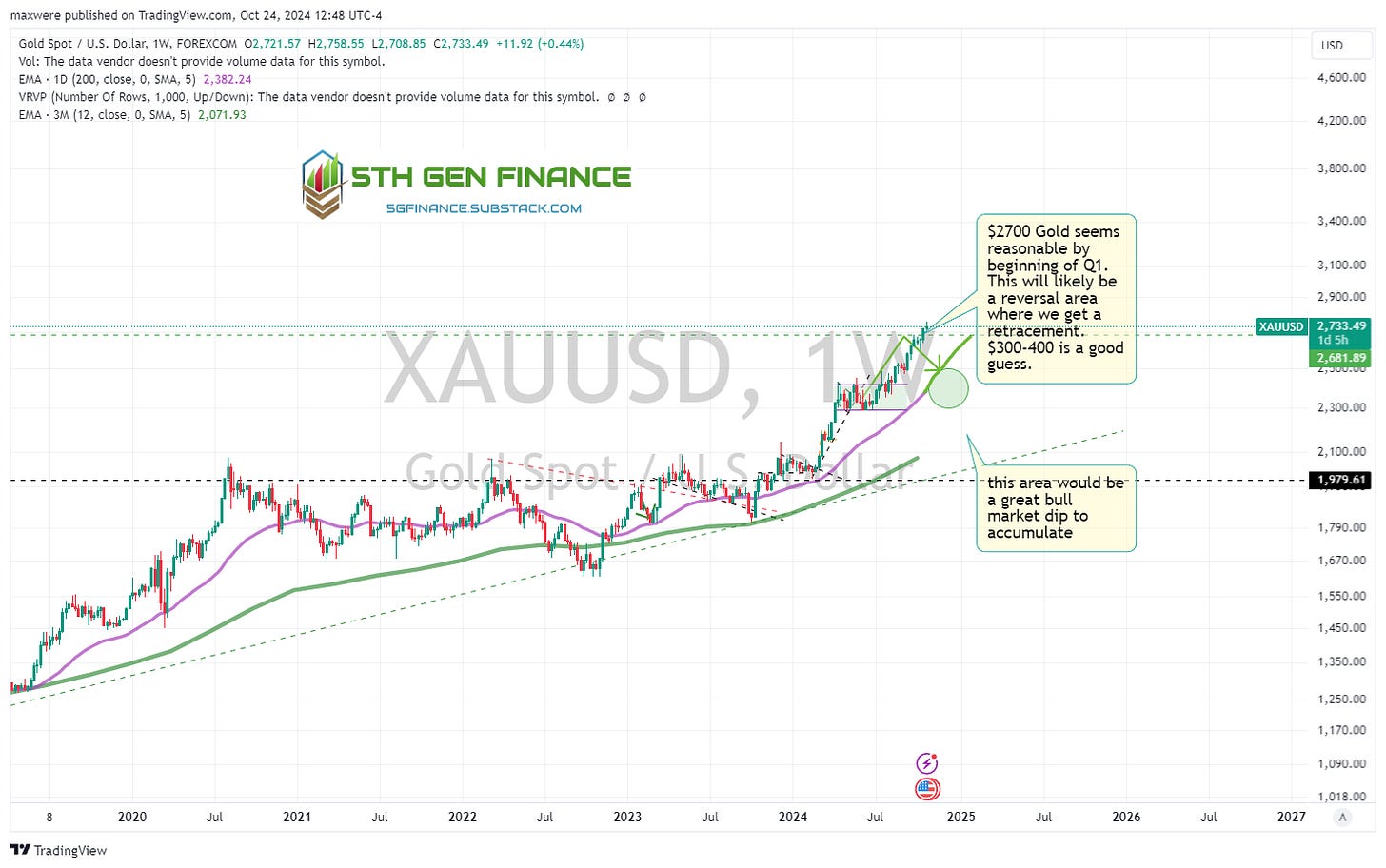

If you are like me, that sounds like a sale… feels like a sale. But what price do you limit order? More on that, lets look at the gold chart itself:

I haven’t updated this chart since my last posting. A retracement to $2400 or so still seems likely. That means a bit more downward pressure on the likes of Newmont and other big names.

More than likely, that corresponds with what is the beginning of a larger retracement in NEM 0.00%↑ (the worlds largest gold mining company). Fundamentally, I expect NEM 0.00%↑ to continue to improve on its cost control as it integrates the Newcrest purchase further. 2-3 quarters from now, news could come as a bullish surprise, fueling the inverted Head and Shoulders potential setup you see below.

Ordinarily, I would not aggressively buy the right lower shoulder of an IH&S based on a chart alone. However, the broad based evidence, combined with economic fundamentals and technical support suggest this morph. The gold bull market provides further confidence in a dip buyers strategy!

Conclusion

NEM 0.00%↑ is a hold at this point. It turns to a buy below $46. As for the timing, I think this years outperformance will take a pause barring a vertical breakout on the metal. To the eye, it appears the pattern has work to do to morph into existence. Next year should be fabulous. Entries below that $46 level could have outsized returns!

**Disclaimer:**

The information and outputs provided by this 5th generation finance model are for informational purposes only and should not be considered financial advice. While the model utilizes advanced techniques, financial markets are inherently complex and subject to unpredictable changes. Following the model's recommendations does not guarantee positive financial outcomes, and there is a possibility of financial loss.

**Important:**

* It is crucial to conduct your own independent research and due diligence before making any financial decisions.

* Consider seeking professional financial advice tailored to your specific circumstances.

* You are solely responsible for the investment decisions you make and the associated risks.

Thank you for the write up of this!

Id love of you Continued watching this and let us know what you see in the rout forward🙏🏻