Breakouts On Big Divies!!!

This is a short post on weekly breakouts from 9/20. Long term value with good technical indicators.

Gold is a great long term investment, but the cashflows are terrible… - Random guy from work

DISCLAIMER: This close was a quad witching Friday. That suggests that institutional markets are likely to bid the short term prices higher into this close. Prudently, you should consider next weeks close above the breakouts as confirmation to this weeks.

This list includes companies that have great fundamentals and are generally priced at value and cash flowing.

BTG - B2 Gold

Company pays 5% dividends.

Base case… excluding their Fekola project that was recently permitted. Assuming level gold price and cash costs. Excluding all exploration optionality (freebies). Assuming 12 year production life span:

They should be grading into the Goose project by 2026. That projects roughly 900m FCF at current pricing assumptions. This company is a bargain and should play catchup with the overall gold mining sector!

FRU/FRHLF - Freehold Royalty

7.5% yielding Canadian oil and gas royalty play. This is a Rick Rule pick (as is BTG).

Base Case Assumptions:

17 years of forward reserves

75% FCF/Revenue on those assets based on average analyst projection

Current o&g pricing

No asset replacements

I have them at a 15% discount with relatively conservative assumptions. This does not include forecast of a natural gas revolution in Canada (which I think is highly likely over the next 15yrs if not the wishes of the current administration). This is in line with other analysts 1 year target.

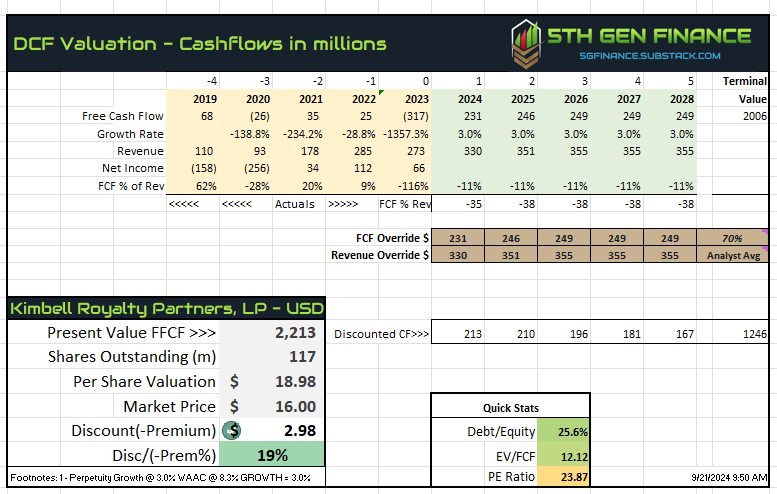

Honorable mention - KRP

Backtesting its breakout in a similar pattern. 11.5% dividends.

Kimball base case with similar assumptions to FRU.

**Disclaimer:**

The information and outputs provided by this 5th generation finance model are for informational purposes only and should not be considered financial advice. While the model utilizes advanced techniques, financial markets are inherently complex and subject to unpredictable changes. Following the model's recommendations does not guarantee positive financial outcomes, and there is a possibility of financial loss.

**Important:**

* It is crucial to conduct your own independent research and due diligence before making any financial decisions.

* Consider seeking professional financial advice tailored to your specific circumstances.

* You are solely responsible for the investment decisions you make and the associated risks.