Lower prices: Coming to a retirement plan near you

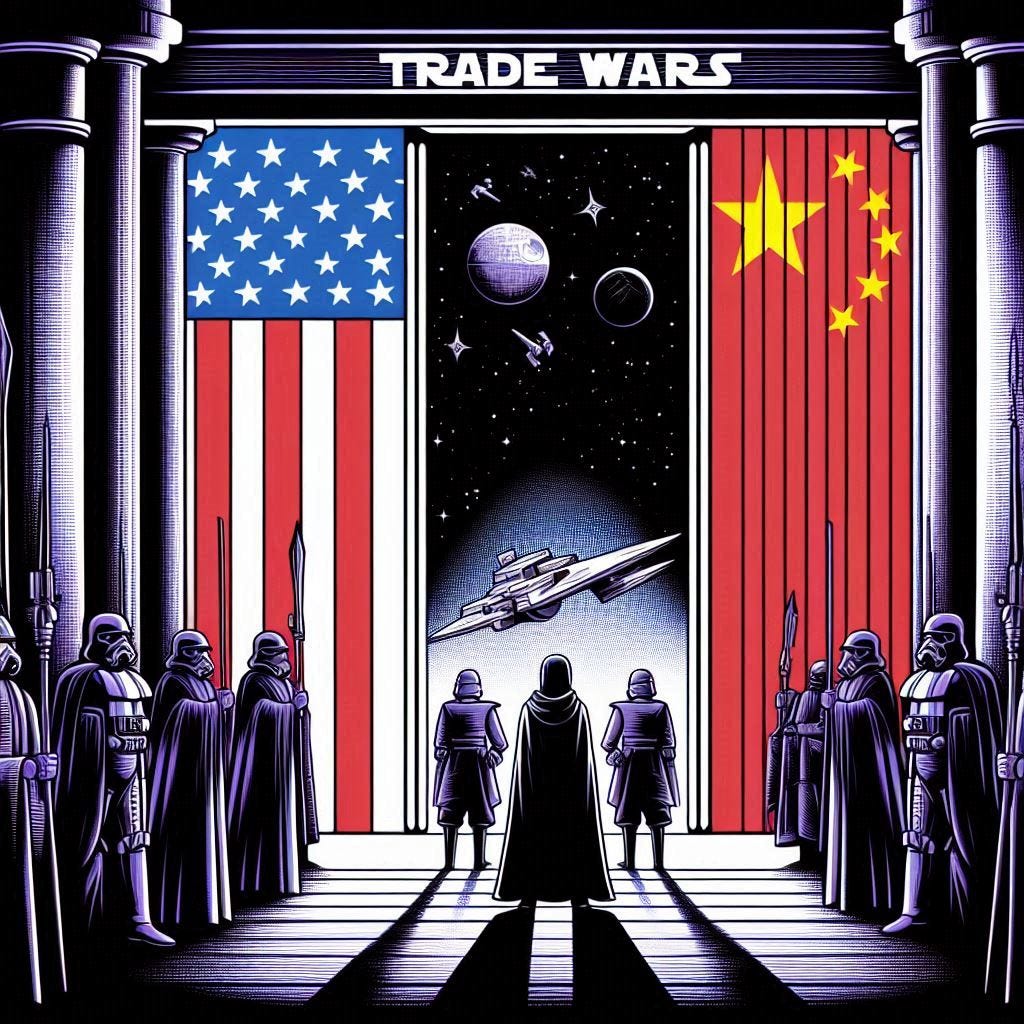

Keep your retirement out of the tractor beam...

When goods don’t cross borders, soldiers will - Fredrick Bastiat

In a recent interview, Scott Bessent suggests talks with president Xi are ongoing. We don’t know exactly what that means, but you “don’t know what you don’t know” (and if you took a look at Friday’s price action you would know that).

As Bessent aptly misquoted Warren Buffet (it may have been Charlie Munger).

In the short term markets are voting machines, but in the long term, they are weighing machines — Either Warren Buffet or Charlie Munger (or someone else who made a lot of money being patient)

Markets as Information Systems

Price is the information metric that fuels decision making in global interconnected business. When this signal becomes confused, we call that volatility (increase trading range/fixed interval of time). Volatility is doubt for the planning type, opportunity for the trading type. Globally connected businesses are of the planning type and the tariff talk is going to project very badly for business until the picture for the near-term future clears.

Thursday saw the introduction of US tariffs on imports. Broad markets sold off, but safe haven assets like gold and treasuries held up. Gold and gold stocks were “dip bought” very rapidly. Then came Friday. China retaliated by announcing counter tariff on US goods. A full scale trade war began and no one really knows what that means in the near term. Precious metals were unable to maintain position against the selloff and capitulated with everything else.

Daniel Kahneman is well known for his theory of thinking fast and thinking slow. Rather, thinking fast when you should be thinking slow. International trade diplomacy should be slow thinking. The market reacted with fast thinking. When this happens, buyers exist only in the safest assets until the smoke clears. Once markets get a clearer picture and engage in slower thinking, price volatility will take a break and we will see some definition in capital rotation. In this author’s opinion, that is what you should concern yourself with.

In the Long Run

The global revaluation process has begun with a bang! Most of this action won’t make the headlines, though. This will be a day-to-day plod from overvalued deployment of capital to undervalued. We should continually test this thesis as we move along.

A long-term investor with enough cash and liquidity to pay his bills for the next 12 months really has no business case to sell assets provided they are on the right-hand side of fig1. There isn’t a risk of long-term permanent loss in this situation. Don’t let the short-term thinking (thinking fast) interfere with your long term view (thinking slow). Did the economic situation of the world materially change on Friday?

In the Short Run

In the short run, we are likely to see money flow into treasuries and high-quality currencies while smart money “figures this out”. They may have figured it out on Monday. But for now, this is the pattern.

Is this a repeat of 2008 (liquidity crisis)?

The short answer is “no, at least not yet”. The key indicator will be widening credit spreads and reduction in bank liquidity pools such as the fed reverse repo facility. This last week saw banks demand collateral in exchange for cash. I suspect this was due to speculation of short-term increase in value (demand driven) of the US 10Y treasury. Lower yields offer some relief to distressed banks, albeit temporarily. It doesn’t mean a liquidity crisis isn’t coming, probably not in the next week or so.

On the other hand, plenty of people have been warning of the bubble, including this guy:

Markets On The Brink?

Everything seemed fine on June 23, 2021 to the residents of the Surfside FL, Champlain South Tower. Then, the unthinkable struck when the tower collapsed after 1 AM the next day. Nature teaches us that physics works very gradually, then all at once. Markets can work the same.

Still Out In the Storm?

So, you find yourself over deployed to US equities and standard retirement indexes. Most people like to admit they “don’t look at it”. That is a mistake in my opinion. We are due for 50% correction in mainstream US equity markets. If we see layoffs and early retirements spike, the passive inflows will become outflows and this bear market can persist for many years. You will lose those years if you stay the course. (before inflation)

An exit strategy is to sell the rallies. Violent crashes encourage large short positions that get quickly squeezed to cover as fast as the crash emerges. Likewise, an entire industry of counter trend traders will make money on the bounce. Expect a bounce. Below is a chart I posted last month:

We may or may not descend to the blue area before shorts take profits, but I would expect a retracement this month to the 5500 S&P level or so. This will create a natural an obvious left shoulder. From this left shoulder we can easily see -35% performance over the remainder of the year. DON’T GET LEFT OUT. Limit stop sell at 5500.

There isn’t much reason to show Nasdaq here, because the story is the same and the timing of retracement will be the same.

Also keep an eye on…

Oil. We are about to slip off the pier here. Expect $42 (or lower) when we do. On the other hand, this could be a false breakdown. Something kinetic could happen soon in the world. If we lose the level here, there will be exceptional buying opportunities in energy stocks. Lux is signally a bullish liquidity pool, we could bounce out of it still.

Stay liquid, stay solvent… not all wars use missiles.

**Disclaimer:**

The information and outputs provided by this 5th generation finance model are for informational purposes only and should not be considered financial advice. While the model utilizes advanced techniques, financial markets are inherently complex and subject to unpredictable changes. Following the model's recommendations does not guarantee positive financial outcomes, and there is a possibility of financial loss.

**Important:**

* Options trading carries a high risk of loss of capital. Trade at your own risk

* It is crucial to conduct your own independent research and due diligence before making any financial decisions.

* Consider seeking professional financial advice tailored to your specific circumstances.

* You are solely responsible for the investment decisions you make and the associated risks.