Dundee Precious Metals Review

This mid-tier producer still offers deep value after a good run. $DPM.TO $DPMLF

Company website: https://dundeeprecious.com/

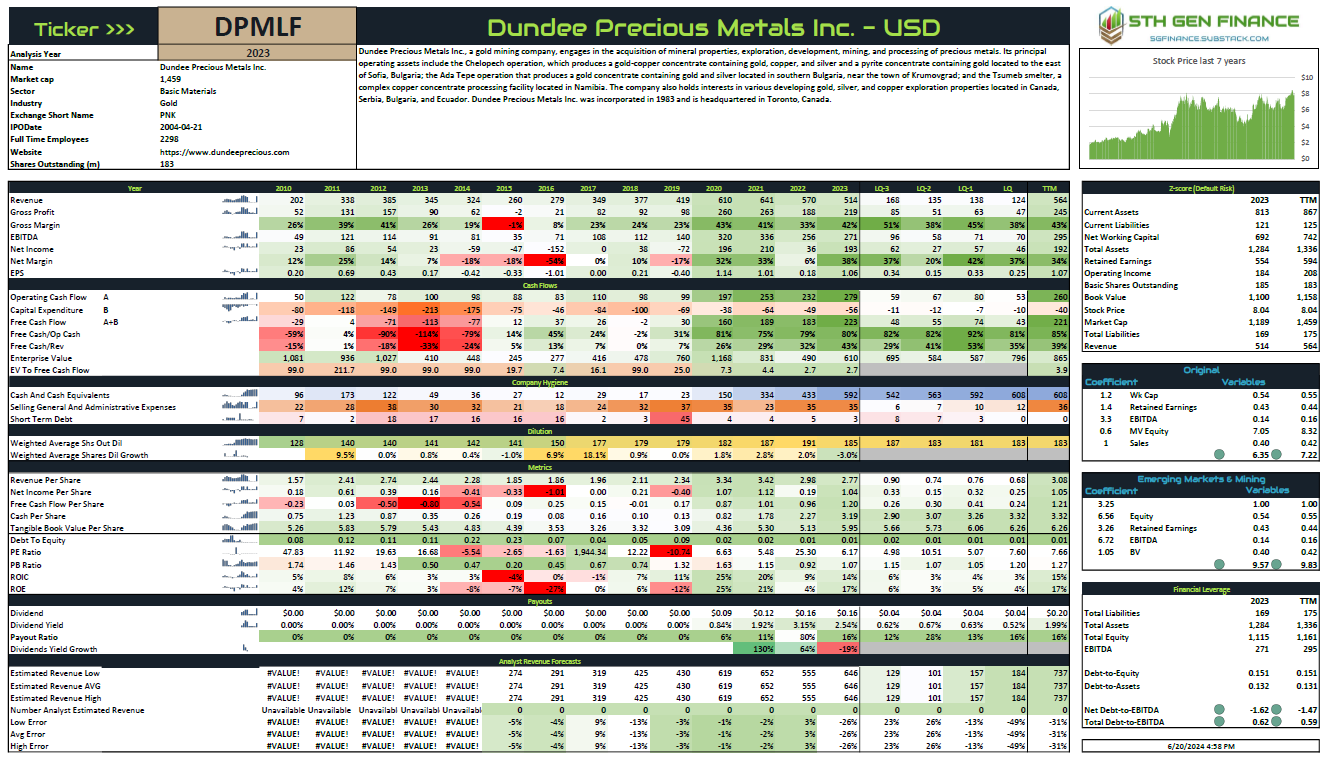

Dundee Precious Metals Inc., a gold mining company, engages in the acquisition of mineral properties, exploration, development, mining, and processing of precious metals. Its principal operating assets include the Chelopech operation, which produces a gold-copper concentrate containing gold, copper, and silver and a pyrite concentrate containing gold located to the east of Sofia, Bulgaria; the Ada Tepe operation that produces a gold concentrate containing gold and silver located in southern Bulgaria, near the town of Krumovgrad; and the Tsumeb smelter, a complex copper concentrate processing facility located in Namibia. The company also holds interests in various developing gold, silver, and copper exploration properties located in Canada, Serbia, Bulgaria, and Ecuador. Dundee Precious Metals Inc. was incorporated in 1983 and is headquartered in Toronto, Canada.

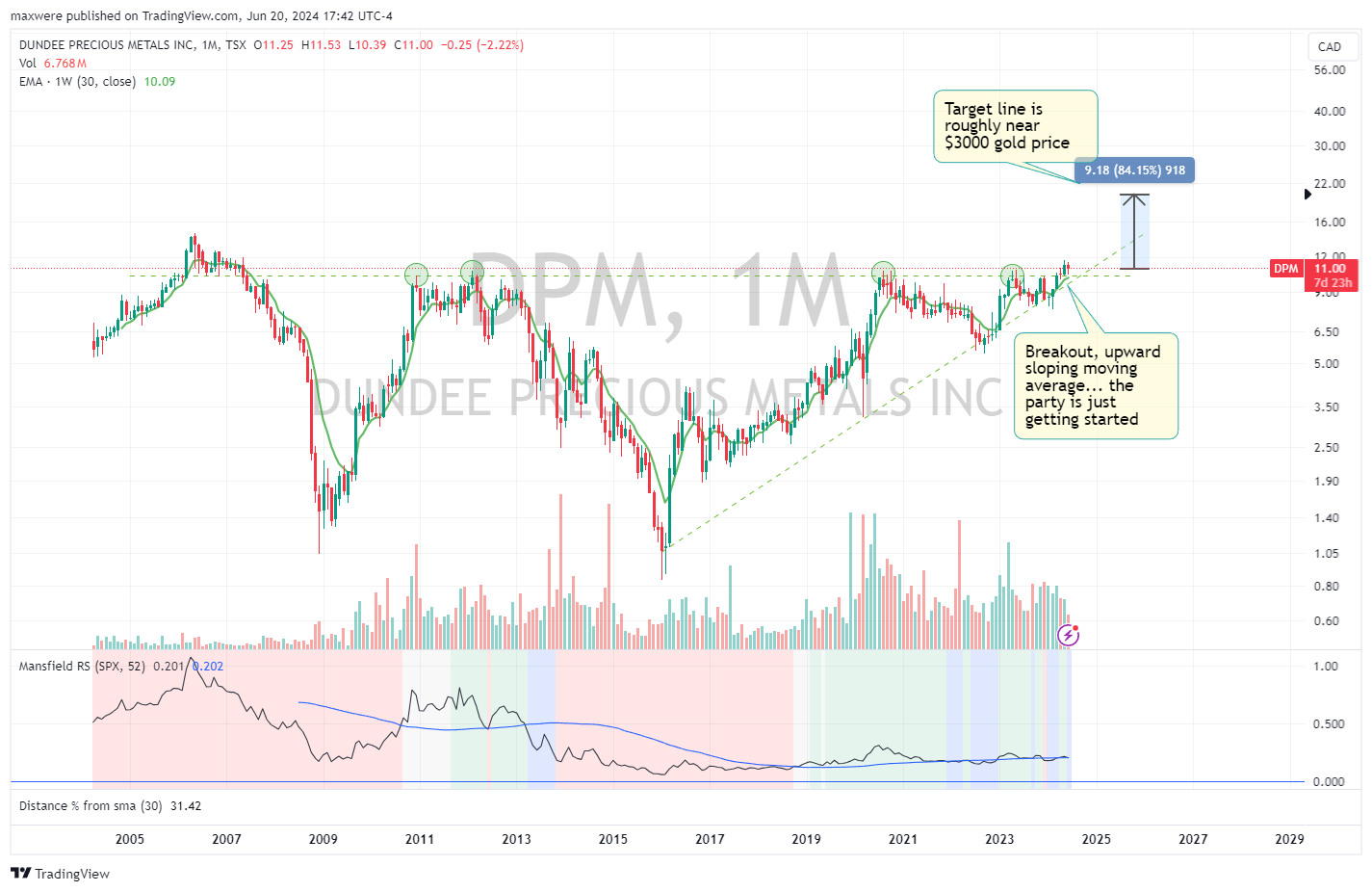

Using the Stage Analysis Model

On the monthly chart there were 4 major rejections along the green resistance line. Last month we saw a clear breakout of major resistance. The target is roughly 85% from here or around $20 Canadian. Valuation metrics suggest this will occur with gold near 3k, give or take. The company has been in stage 2 since 2018 or so.

BUY

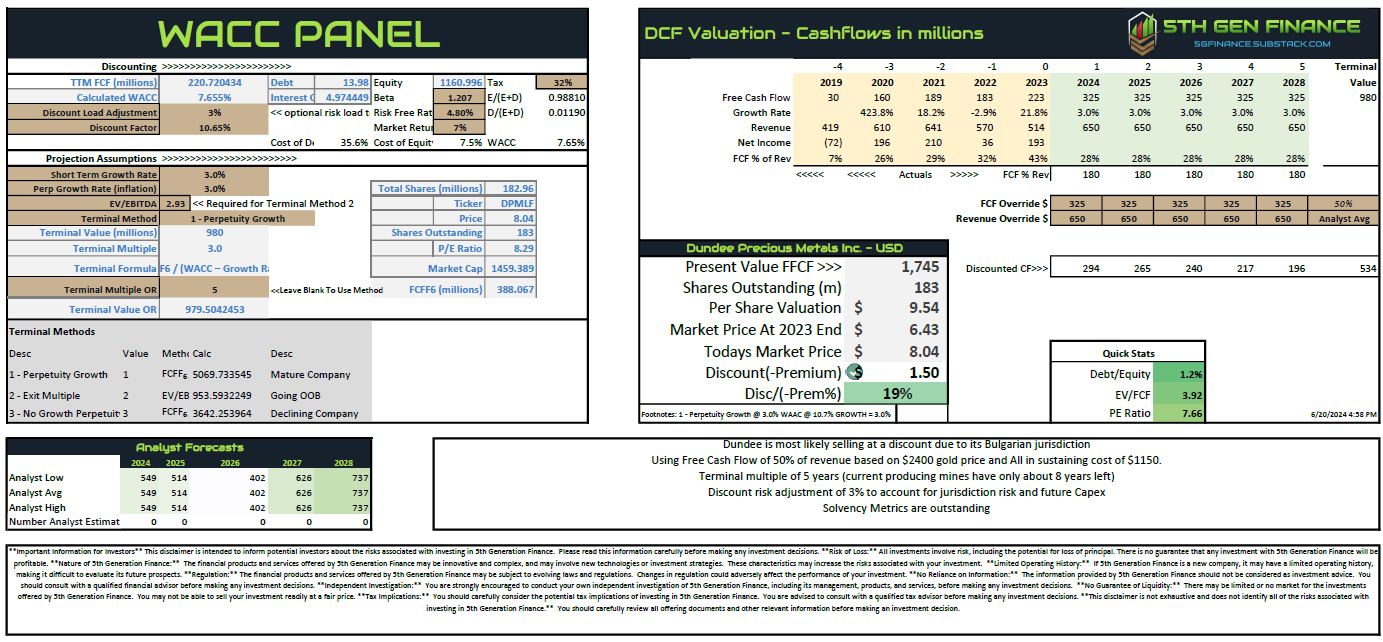

Using the Kitty DCF Model

First the good business trends…

Stock repurchases

Growing cash

G&A expenses under control

Solvency scores are outstanding

Dividend is covered

No significant debt

The bad trends…

There is room for a higher dividend

(not pictured) the company has a very small insider ownership.

The Forecast

Assumptions:

We used the free cash flow at the current gold futures price (slightly conservative)

We used a 300 bps load to cover capex and add additional conservative pad

We projected the company for only 10 years, since their two major mines have 8 years of life left. This prices the company at current production (excludes the value of future exploration and development… you get that for free)

Market Price:

The forecast price of $9.54 is based on the OTC USD ticker DPMLF. We’d recommend limit orders only on OTC, but there should be plenty of volume for the retail investor to add to the portfolio.

BUY

Conclusion:

Buy and hold strategies and gold miners go together about as well as oil and water. Mining is capital intensive and gold is scarce. That is to say, there are very few companies that consistently make money at less than peak cycles. Dundee has proven it can be one of those. It has moved to a viable cash flowing business stream in advance of what we believe is long term gold bull market.

**Disclaimer:**

The information and outputs provided by this 5th generation finance model are for informational purposes only and should not be considered financial advice. While the model utilizes advanced techniques, financial markets are inherently complex and subject to unpredictable changes. Following the model's recommendations does not guarantee positive financial outcomes, and there is a possibility of financial loss.

**Important:**

* It is crucial to conduct your own independent research and due diligence before making any financial decisions.

* Consider seeking professional financial advice tailored to your specific circumstances.

* You are solely responsible for the investment decisions you make and the associated risks.