Weekly Updates: Trading and Investing is Hard

When you can't control your emotions (greed), you will likely make the wrong decision. I'm looking at key ETFs and futures charts to see how Fridays chaos all shook out. (It wasn't that bad actually)

This is not investment advice. If you seek advice talk to your investment advisor or financial planner.

Today’s drop was probably my largest on a nominal basis. Although, nothing in the highest risk range of the portfolio compared to the best 2-3 days over the last month or so.

Two things really help deal with the emotions of volatility. One is technical and the other is fundamental.

Technical: Plot a roadmap on your high time frame charts depicting likely outcomes including pullback zones and full break downs. Compare your analysis with others if available. This will give you the courage to add on bull market dips.

Fundamental: Determine a realistic value of the stock you own under a variety of market conditions. There are an number of methods to do this. Popular ones are “Discounted Cash Flow”, “Net Present Value” of assets, “Sum of Parts Valuation”. If nothing in a market has changed your equity valuation, then down days can be ignored and you can wait for the market to realize your price, so long as you have a long enough time horizon.

Gold

We could be in for a few weeks of bearish pullback to the moving average.

What should you do if you are looking to buy gold? Accumulate near the major moving averages (30-50WMA, 200DMA).

Gold miners/producers priced in gold

This looks like a healthy retracement in a bull market.

What should you do? Sell gold in favor of your favorite gold miners.

Silver

In the PM bull market, we will see silver move 5+% in a day. Thats completely crazy and also why you don’t chase it.

What to do: If I had to guess, I think the current $29 price holds up. But, it may not. If it doesn’t, then $26.50 is the level or so. That level is a “back the truck” up moment. $29 is a very good price if you feel like you need more. Take advantage!

Silver miners/Silver

Silver miners did not underperform the price of silver in general. We would have expected a larger selloff in miners. This silver sell was a cooling off from the current breakout prices. High quality silver miners will have their day soon.

What should you do if you own silver but few miners? IF you can take more risk in your portfolio, sell some silver to buy miners (leverage).

Copper

Looks like its in for a breather…

Uranium

SRUUF - looks attractive to add positions if you don’t own.

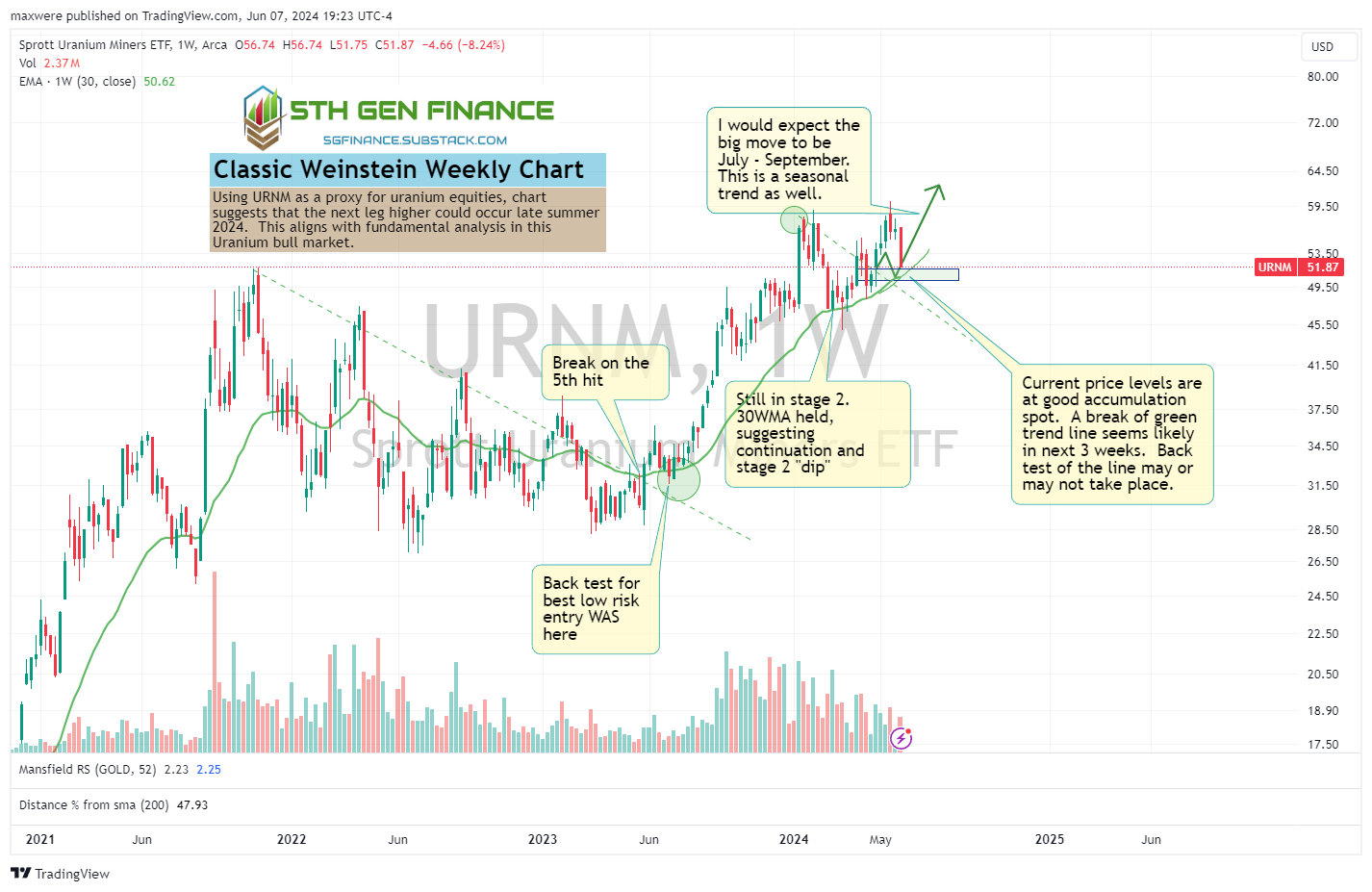

URNM

I didn’t change this chart… still looks good.

What to do? Accumulate URNM if thats on your list.

URNJ

What to do? Accumulate URNJ if thats on your list.

Buy when there is blood in the streets - Barron Rothschild