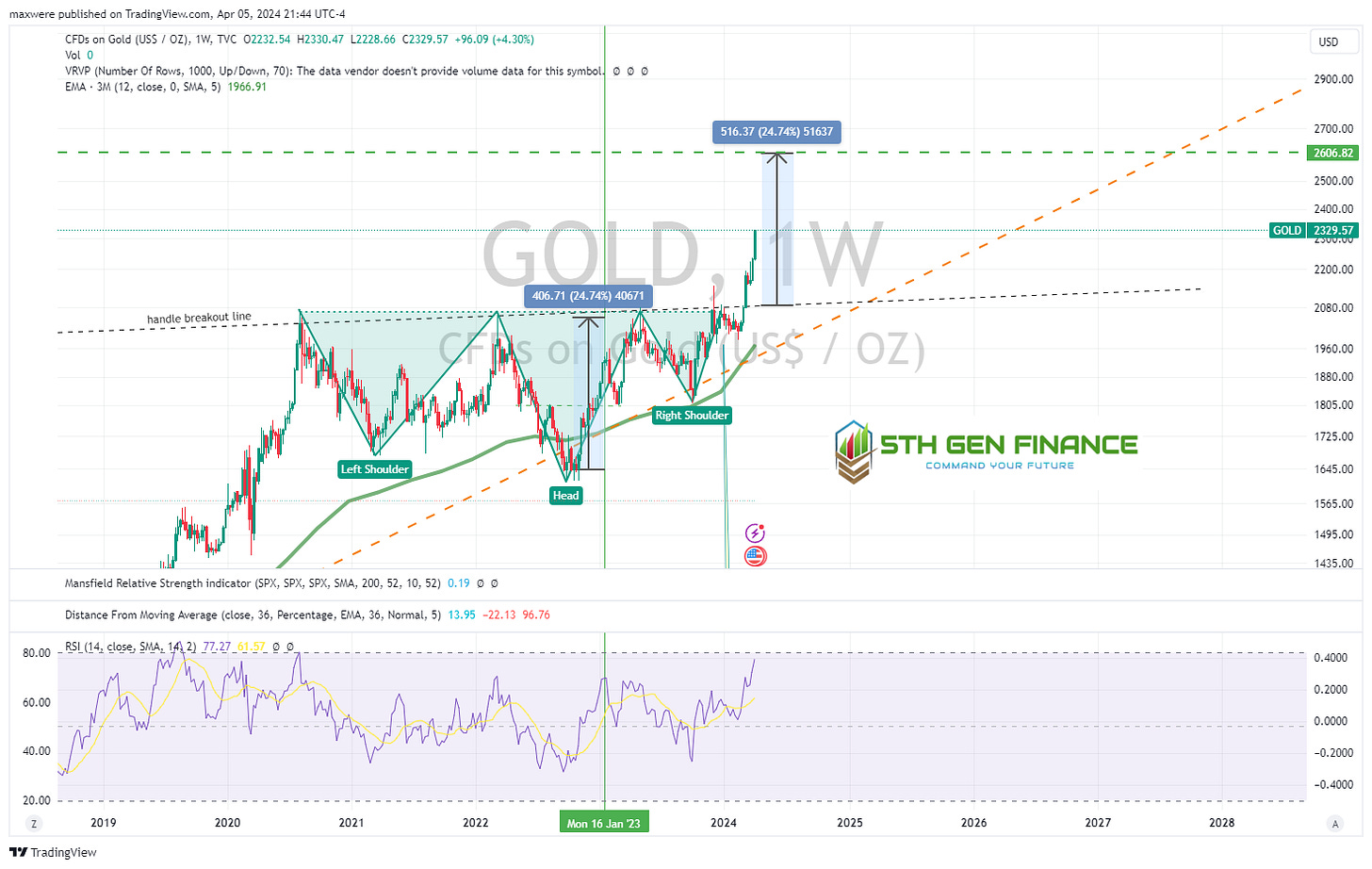

Gold (bullish)

Strong move of the inverted H&S pattern. It should continue in the short term until at least $2400. Possibly take a longer break above $2600.

Gold Miners (neutral to slightly bullish)

Lagging the metal. Most likely the flag breaks out and we get 60-80% on its head and shoulders move.

The most optimistic gold stocks at the moment are Barrick (GOLD) and Dundee (

Silver (Bullish)

A pullback dip buy at $26 is prudent. Silver is volatile with tighter supplies. Pullbacks may only be slight. Initial target is $37.

Silver Miners (Bullish)

SIL - Global X Silver Miners ETF

“Walter” (the institutional market operator) made and appearance. He’s buying. That means you should think about it as well. He’ll only tell you when he’s ready to unload. How do we know? This weeks big fat volume bar.

WPM - its largely a silver royalty play. Outstanding looking chart.

Producers (AG, PAAS, AYA, SILV, FSM… technically a gold company)

Copper (Bullish)

Copper Miners (Bullish)

Inverse head and shoulders movement (not perfect but close). $62 short term target is reasonable. Long term we go much higher.

Oil (Bullish)

Good chance oil breaks above $100 by early summer.

Energy Companies (Bullish)

Royalties…

DMLP - headed toward 50s. Outstanding MLP. A must own.

After many weeks sideways BSM Royalty looking like a move higher is coming. Not a major breakout yet, so this stock is still neutral. A must own MLP.

Kimball Royalty Breaking out… this is buy (bullish)

ETFs (XOP, XLE)

Agriculture

Potash and Nitrogen is the order of the day. This is a very good fundamental and technical setup. This week we had a follow through candle suggesting a breakout. I’m looking to expand my position on this stock this week.

NTR (Neutral - Bullish)

Next week I’ll work on some of these bull call option setups on the ETFs…

Cheers!