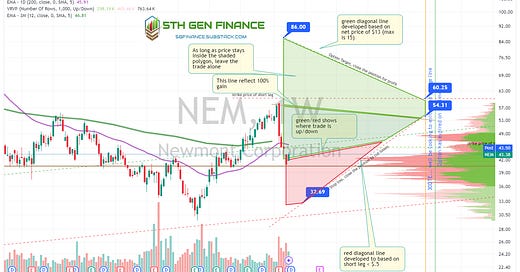

Newmont options update

Still what I feel like is a good entry zone for this vertical spread trade. Entry is somewhere around $3.60 at this current price.

A-Mark

Hold.

Entry rolled over and from a trading standpoint should have been a stop out for a small loss. Back to the 200dma, now that gold is reversing I will probably ride this for the next week or two and close. It was only half the position I intended to deploy.

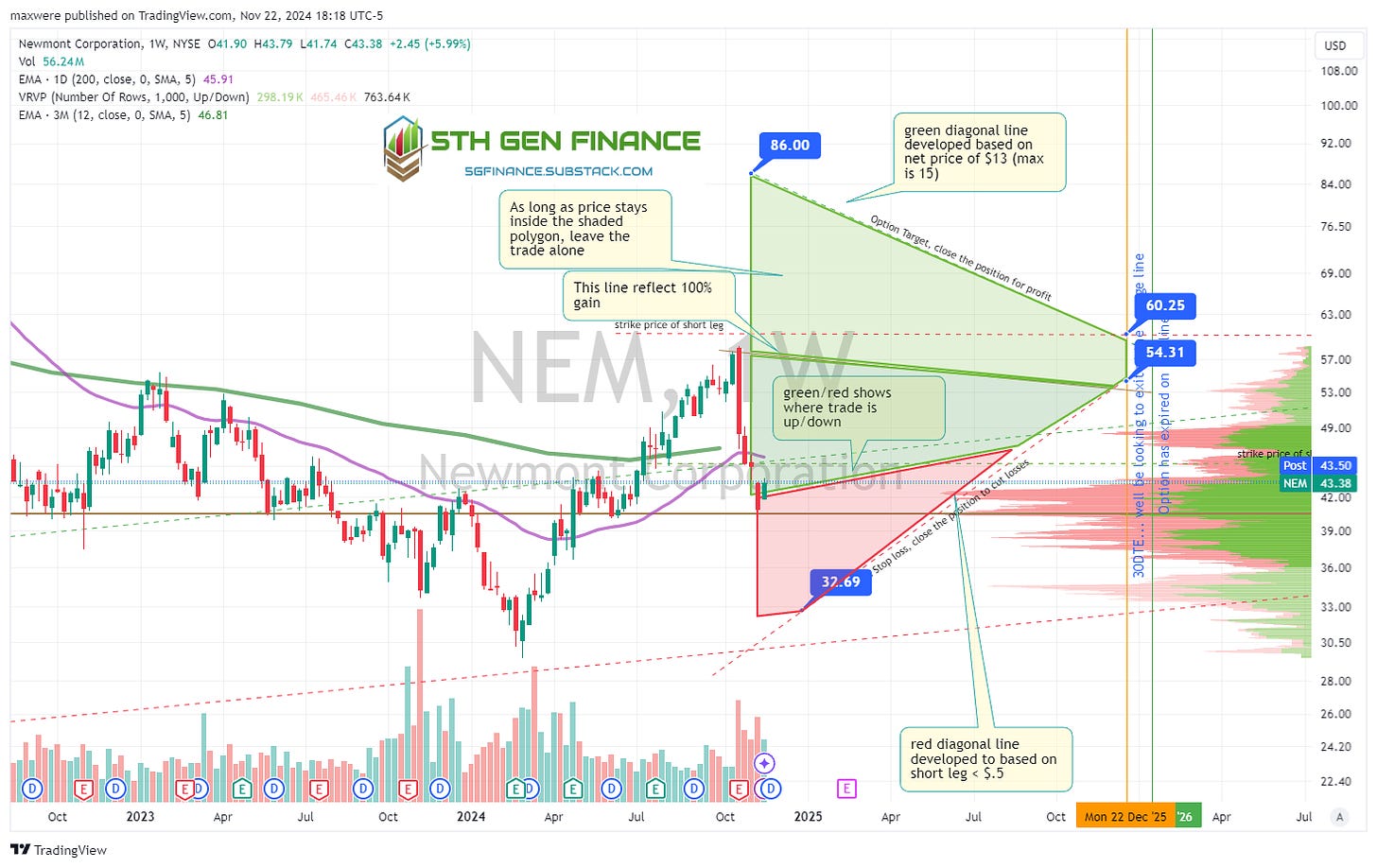

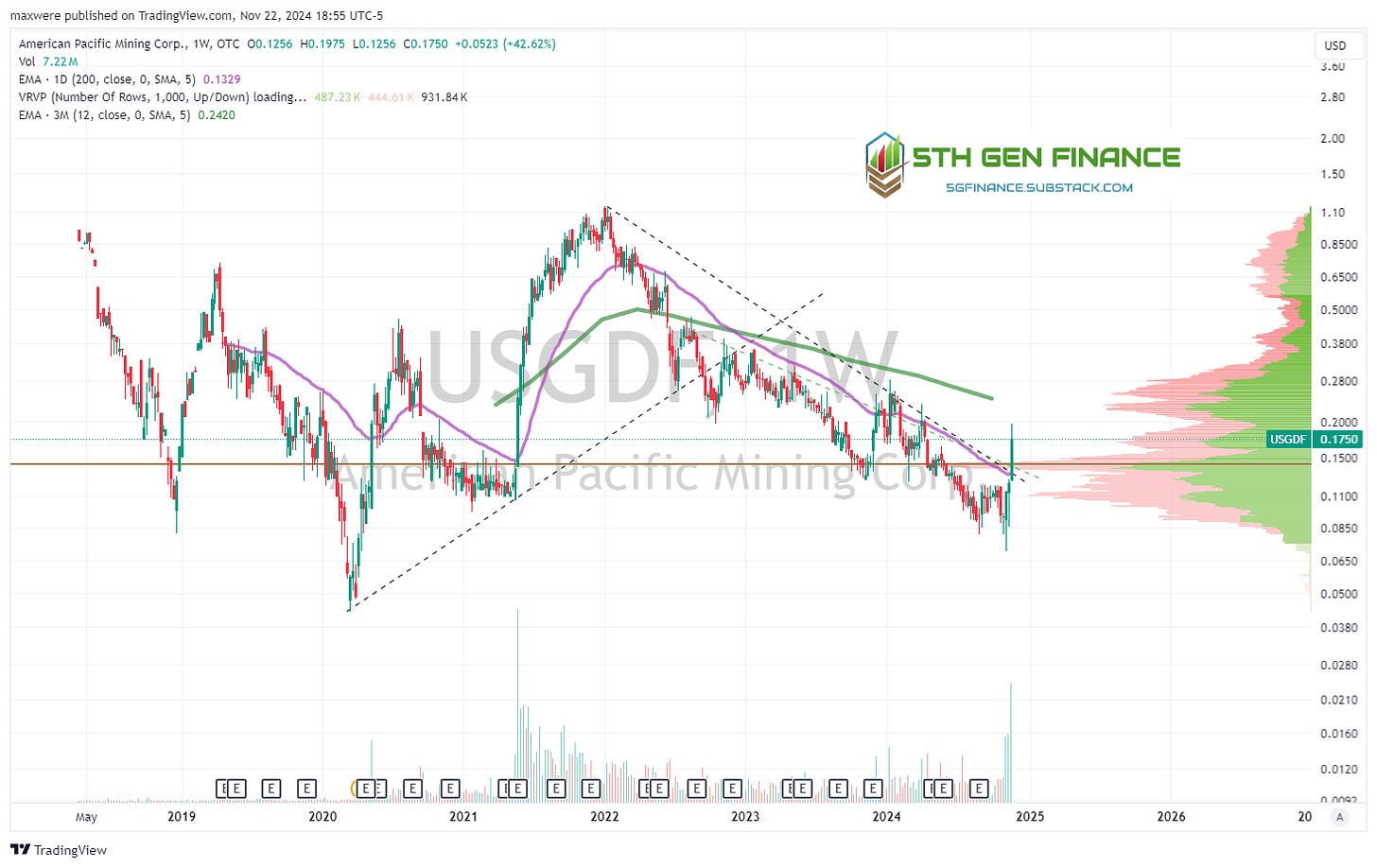

RRL - Regis

So far this trade is working as predicted (no change to the chart). We got in only half of the full position. The ASX can be trickier to get filled.

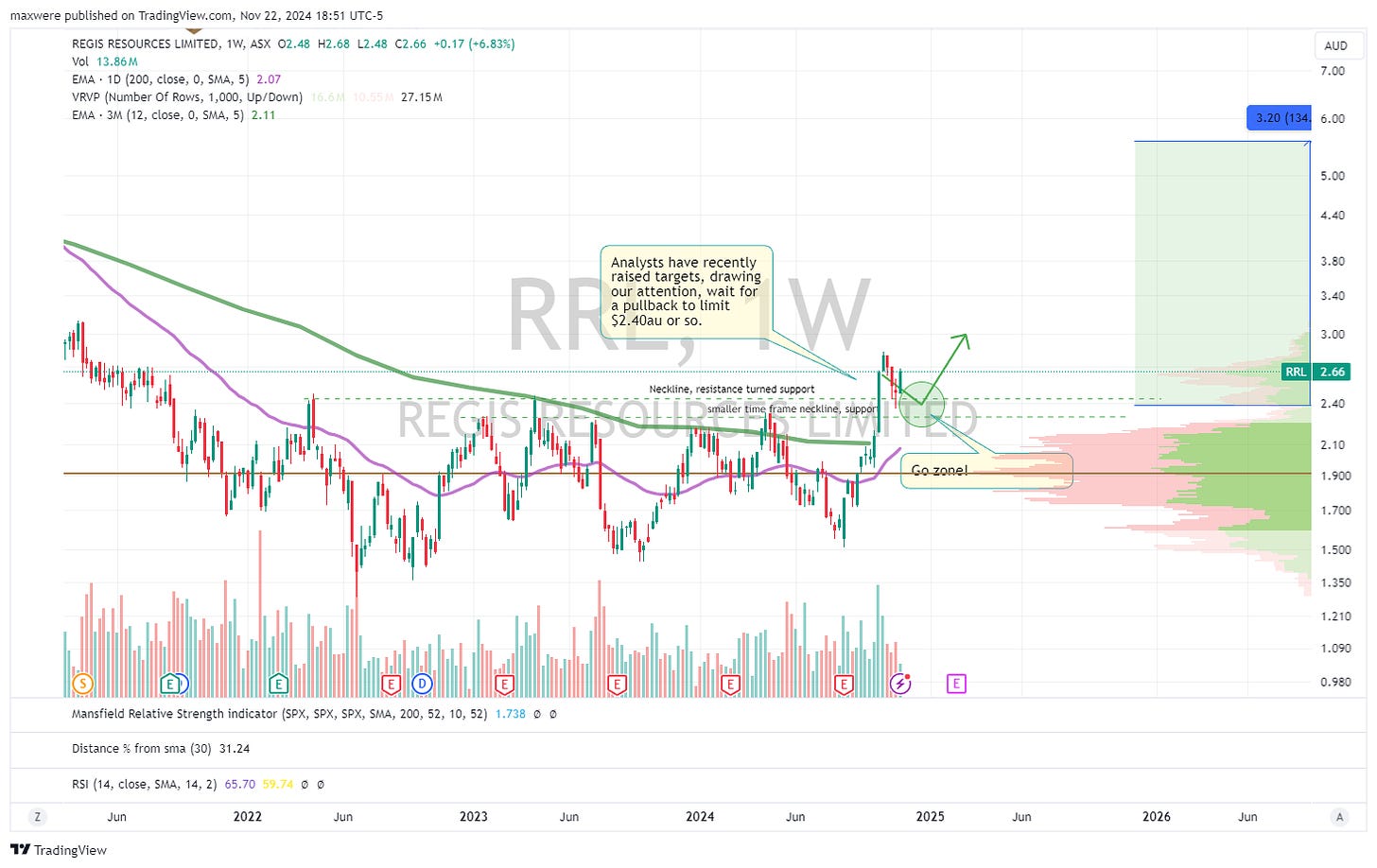

American Pacific Mining (gold)

Weekly breakout on this junior.

SAND - Sandstorm Gold Royalty

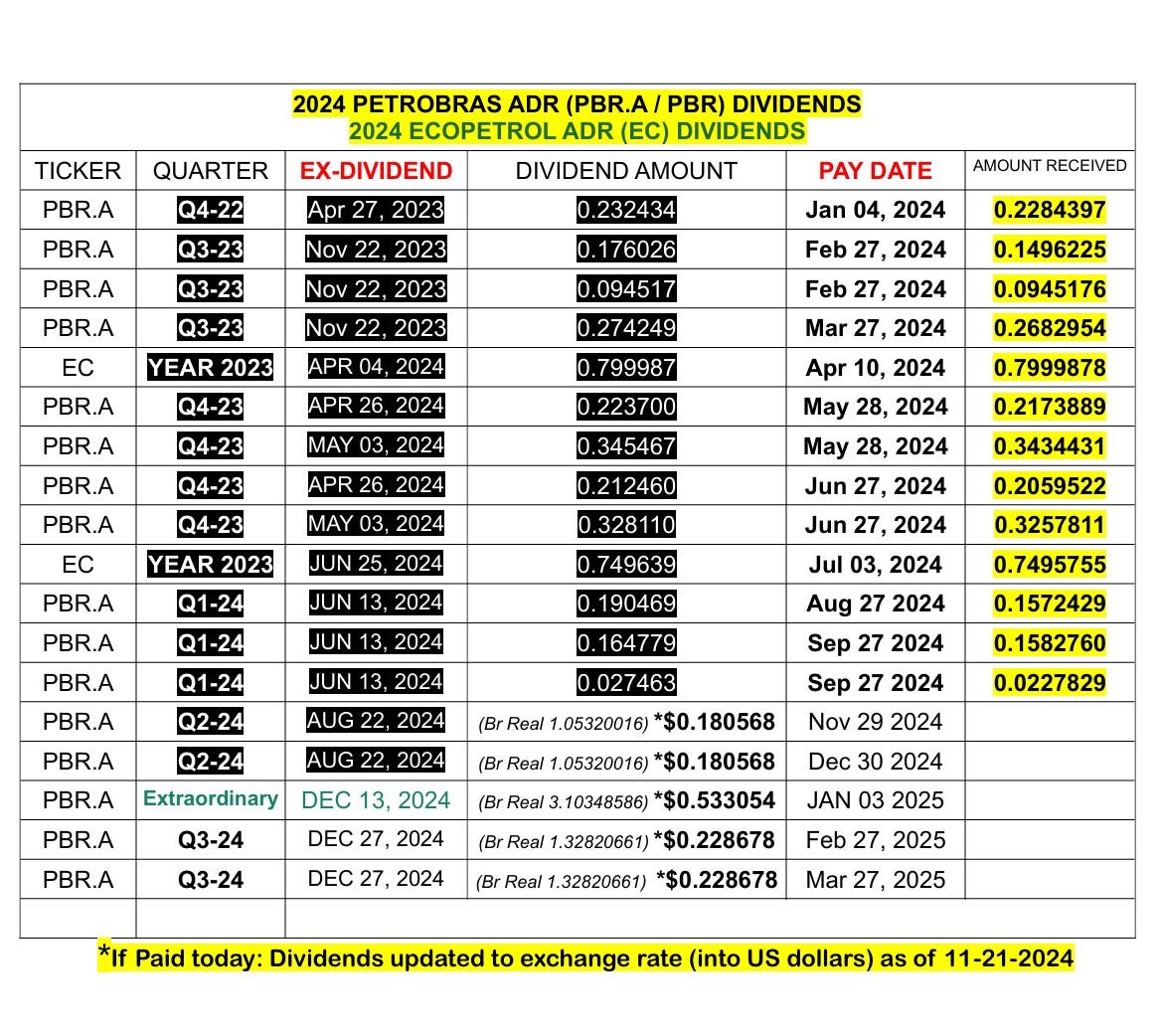

PBR.A

Pushing a breakout on PBR. Huge earnings, here’s what the dividend picture looks like. Ex divs in December, you have ~$1 coming.

KRP - Kimball Royalty

I had buy the green circle, still a buy. Big dividends. Ditto on BSM below.

BSM

TOU - Tourmaline

Tourmaline broke out this week. This is major Canadian gas producer with large resources. Bullish tailwinds of cooler than expected winter and talk of deregulating infrastructure, combined with a strong cashflowing earnings and there is reason to believe a strong measured move is coming over the next year or so.

PEY

Same song as TOU different verse.

ARX - ARC Resources… Third verse

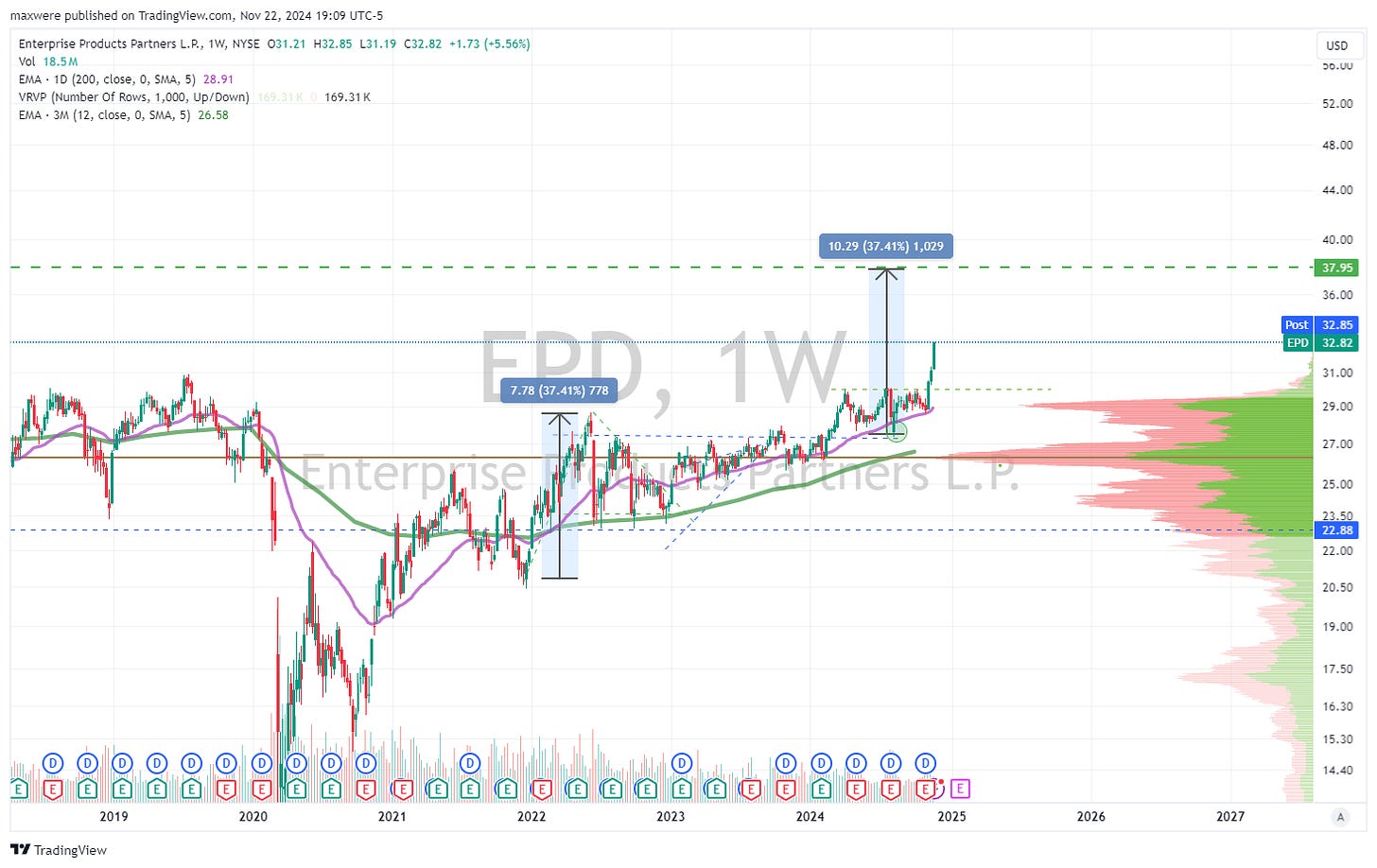

EPD

Getting pretty hot at the green dotted line. This is a hold on a buy.

SM Energy

Breakout on SM. This could be a quick trade to $75. This is a Permian company. I’m looking to add a half position next week.

CVX - Chevron Breaking Out!

I will price a synthetic covered call on this guy next week. I think it could yield a fairly lucrative levered return. The roadmap will be similar to the NEM spread.

All these “buy” entries can be bought now or on slight pullback to the trend lines.

Have a great weekend!

**Disclaimer:**

The information and outputs provided by this 5th generation finance model are for informational purposes only and should not be considered financial advice. While the model utilizes advanced techniques, financial markets are inherently complex and subject to unpredictable changes. Following the model's recommendations does not guarantee positive financial outcomes, and there is a possibility of financial loss.

**Important:**

* Options trading carries a high risk of loss of capital. Trade at your own risk

* It is crucial to conduct your own independent research and due diligence before making any financial decisions.

* Consider seeking professional financial advice tailored to your specific circumstances.

* You are solely responsible for the investment decisions you make and the associated risks.