Uranium Weekly Breakouts - What to do now?

The 3 Things That Move Price (Howard Marks):

Money - Fund Flows, Volume

Passive Institutions - large percentage of trades happen via passive funds and rebalance. EFTs 401ks etc. ETFs purchase stocks/securities based and funds flowing in and sell based on funds flowing out. Technical and fundamentals are ignored.

Active Institutions - Hedge Funds/Investment Banks move large reinvestments of investor capital with heavy TA and FA. They have the volume to manipulate short and medium term prices.

Retail Investors - This group. Brokerage users, certified investors, Robinhood, WSB crowd etc

Momentum - Moving Averages, RSI, trend lines - Price action is the number one measure of perceived future value by retail investor. FOMO. Institutional investment seeks to capture leg up moves creating more momentum. Smart money looks for "roll-over" break down or break out.

Sentiment - Human investor psychology. Often measured by volatility index on a spectrum of fear v greed. This is a measure of how willing an investor is to enter a position. Mass recency bias of investors. What has the market done for/to me lately? That’s what it will do in the (near) future. Put call ratio is a good technical indicator.

The question to start with is, does flow of money, price momentum and sentiment suggest higher Uranium and Uranium Equity prices?

Money (very bullish)

Friday 1/12 was and extremely constructive day in the uranium market… Evidence:

URNM is displayed as proxy for other high liquidity plays such as SPUT, URA and CCJ.

What caused this move? Money. Where is the money coming from? Active Institutional money.

Who was buying SPUT and fund products?

1/12/24

1/11/24

Are we above a rising 200 day, 50W, 3 year MA? Most definitely without a doubt yes!

(URNM as industry proxy)

Sentiment (bullish)

What is the put call ratio? (.22) very low. This suggest call purchases are highly skewed to the bullish side.

(Other non-quantitative view of sentiment would include twitter, analyst ratings and general news cycle.)

Given the excitement, where to get in and how to play?

Strategy 1 - URNM "beta" play entries. The gap fill and 50 DMA would be ideal dips to buy in.

Strategy 2 - front run institutional money and the ETF rebalancing

Institutional money currently has limited access to the small and micro cap space due to low volume of stocks for sale. This is your advantage as the small guy (you have very few against them). To invest in the smaller companies money will flow through the institutional vehicles like the ETFs and possibly other diversified funds. Fund flows via ETFs will drive higher quality small companies much, much higher.

Note: To execute this strategy you will need access to ASX and TSX or be approve to trade OTC penny stocks with your broker. You will need to submit limit orders only.

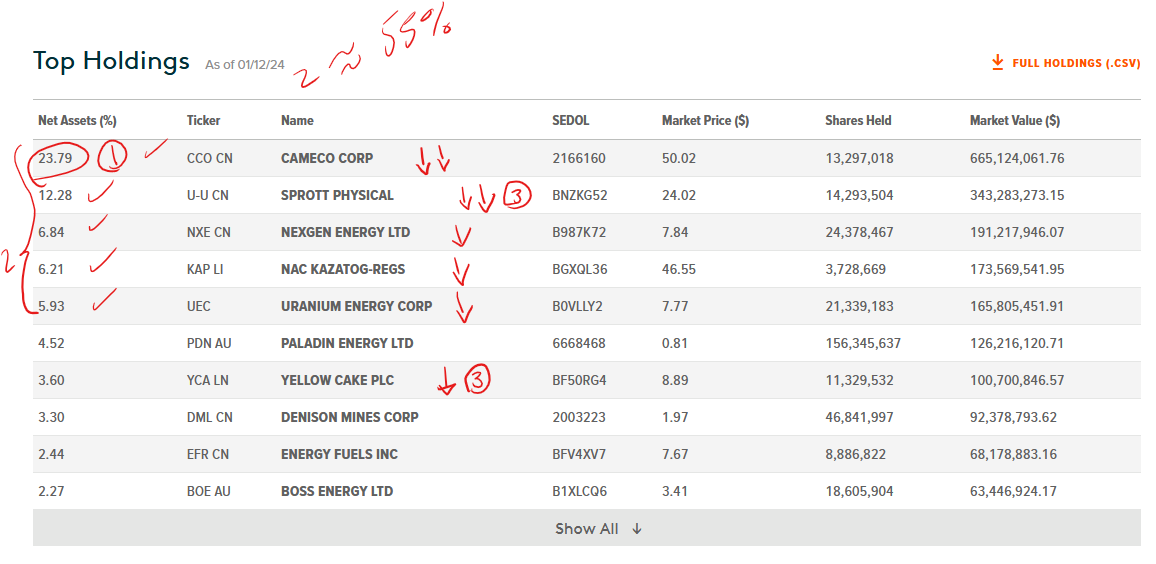

URNM is not rebalanced until march, but URA (https://www.globalxetfs.com/funds/ura/) will be rebalanced at the end of the month. Here are a few things that will happen automatically:

Any single position above 22.5% will be sold down.

Aggregate weight of all companies above 5% weighting is capped 45.5%

Aggregate weight of all physical trusts is capped at 10%

Most likely targets:

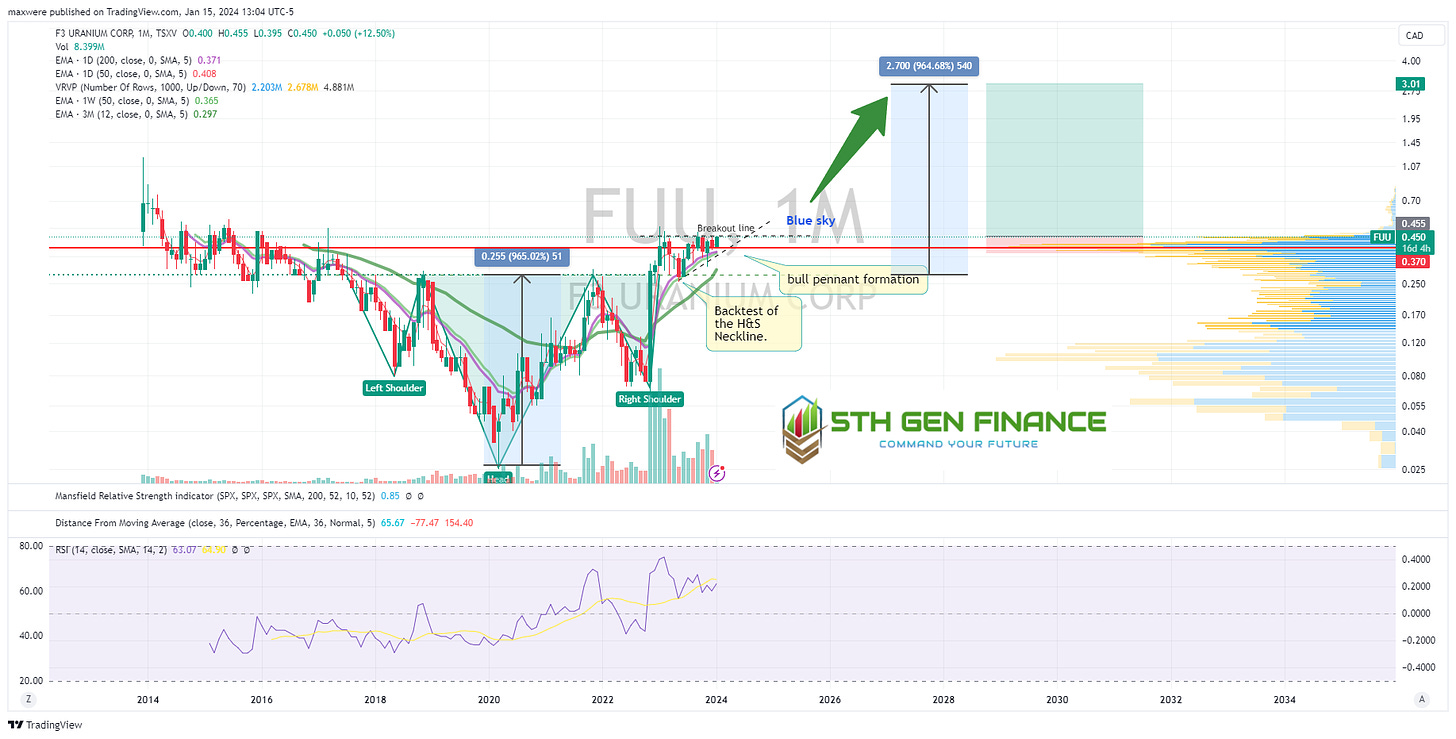

Strategy 3 - Big Alpha Exploreco play (F3 - FUU)

FUU is a hot name in the drill results category these days. Denison owns 6% of the company at conversion price of $.56. F3 is the same exploration team that found fissions asset triple R in western Athabasca.

A completed pattern of the H&S formation below takes the price target to around $3 CAD or about 5 bagger from here. While that may sound fantastical, this would increase the company market cap to about 1b US a valuation that wouldn't be out of line if they were to have a project materialize like Triple R.

Strategy 4 - Singles, Doubles, Tripples, Denison mines (DNN)

While KAP and CCJ are likely to be going to market to fulfill their contracted deliverables (in a short position the physical metal), DNN is clearly in the long. DNN owns well over 2m pounds of above ground U308, that is clearly a liquid asset (though not represented by US accounting standards). Estimated purchase price of that inventory was around $30, so taxes would be an issue if they decided to rapidly liquidate (translation, they are not likely to rapidly liquidate).

Big picture. The measured move bull flag target is in the $6-8 US range. That takes DNN to 7b company. Its M&I resource is around 250m lbs or roughly $30/lb in the ground at this price. Not astronomical yet. My valuation at $60 uranium was $5. In addition they have finished all the legs of their Athabascan ISR technology. IMO, you get the patent of this technology for free as it is likely to fetch a very high royalty for projects looking to dip into earlier than expected production.