Uranium Review Part 2

Continued from last weeks review... Today we look at Encore, Boss and their recent JV asset.

More macro observations…

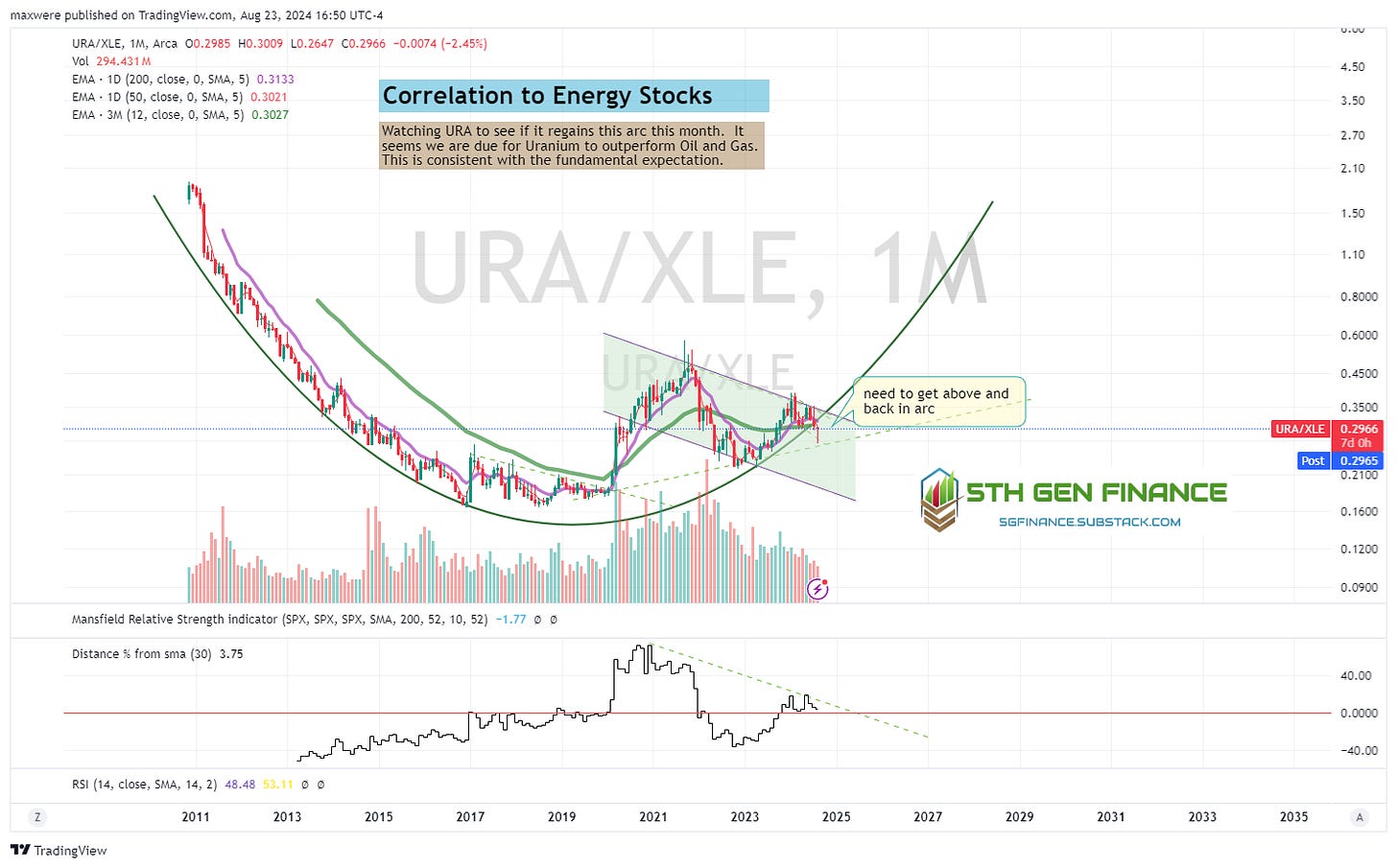

In last weeks article, I outlined the base case for the Uranium macro. We’d be remiss if we didn’t consider the short-term downside, as there are a few bearish looking things (primarily on the weekly time-frames) in the charts and a few others to keep an eye on as we close the month. A brief technical update…

CCJ - Cameco

URA

URA/XLE - Uranium Equities Relative to Oil

Breaking News

As expected KAP (Kazatamprom) revised its 2025 production guidance downward some whopping 13m lbs.

https://x.com/i/trending/1827030517260124346

But wait, there’s more... Supply is reported lower and Budenovskoye (large mine coming online has been delayed to 2027).

https://x.com/lawse/status/1826928264914272723

There are only two kinds of people in the world, those that have uranium at arm’s reach, and those who need uranium (energy consumers)

Near Term Producers (deep dive)

Encore

Encore released earnings last week and there was some surprise in the news that their sales margins for the year were negative. After intensive review of this situation, we believe that this only a temporary shortfall to meet contracts from several years ago that were at sale prices just south of $60/lb. The company has restarted both Rosita and Alta Mesa in 2024. Together they have a “nameplate” capacity of near 2m lbs/year. Due to the “running tail” nature of restarts with ISR (insitu) projects, lbs have yet to be produced from Alta Mesa in spite of it being in production for what is about 3 months now. We are currently modeling for around 600k lbs for the remainder of the year. In addition, realized margins should be much higher as the company will have more than enough supply to fulfill the outstanding contracts for the year. My guess is they are roughly 300-400k lbs.

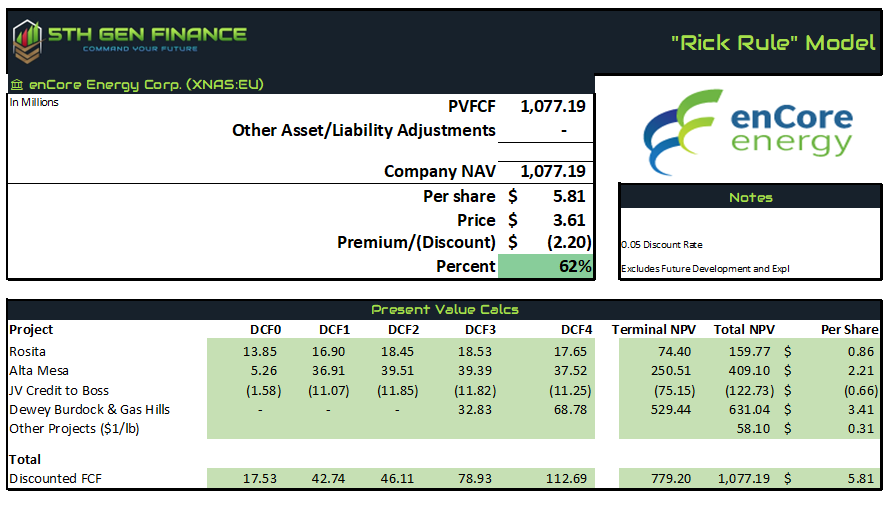

We assume no additional dilution or significant debt is needed to finance the forward pipeline of projects. This gives us a price of $5.81 USD with the following assumptions:

5% discount

Current forward price of the Uranium market

Debit for the JV portion of Alta Mesa with (Boss)

No credits for expansion and de-risking of current assets (conservative)

$1 /lb in the ground on the NM assets and long term assets

80% recover-ability ratio on M&I

Technically, today’s was pretty heated. Still, zooming out, the chart suggests an attractive place to pick shares up at the 3yr MA.

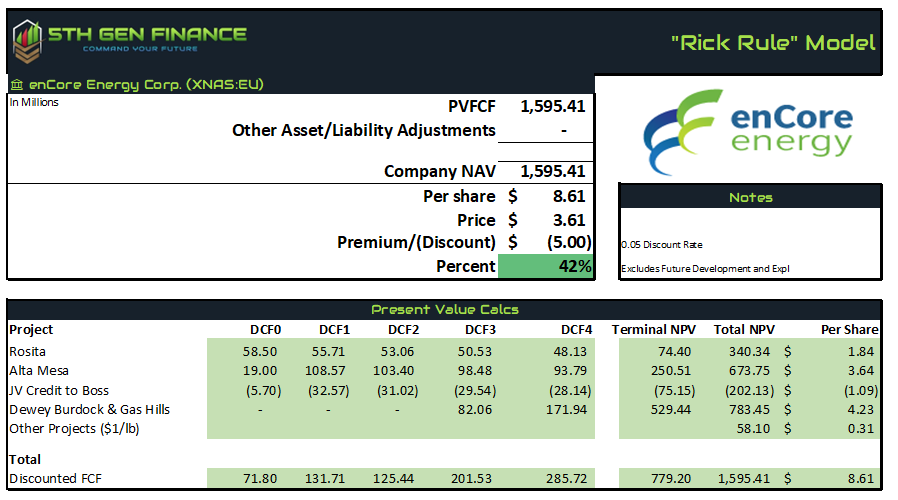

Upside Optionality to U308 prices:

At $150 contracted U308, the company doesn’t forecast a lot of leverage. I think most of the optionality leverage is in the 93% of Alta Mesa that hasn’t been explored. Does This asset triple or quadruple in size? That’s a real possibility. The bottom line, with EU we need to think in terms of exploration optionality, not production. Nevertheless, they are a lower risk US producer and that will have a lot of clout with investors as sentiment ramps up.

Conclusion (Buy)

Encore is a personal favorite as a TX based company. Great management, low institutional ownership and skin in the game make it a top pick. Thus far, they have delivered on time and budget and have demonstrated (after a few equity raises) that they will repurchase some of the dilution with excess cash. We see this company as pretty sure fire 3 bagger, if not much higher.

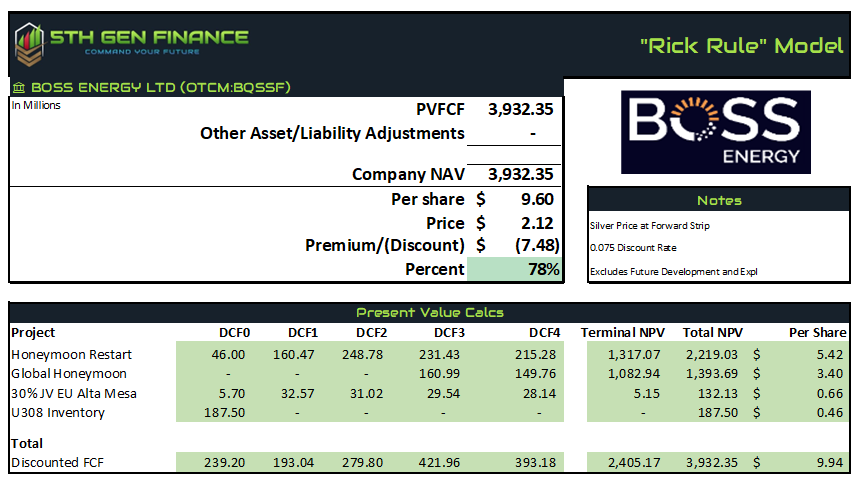

Boss Energy (BOE)

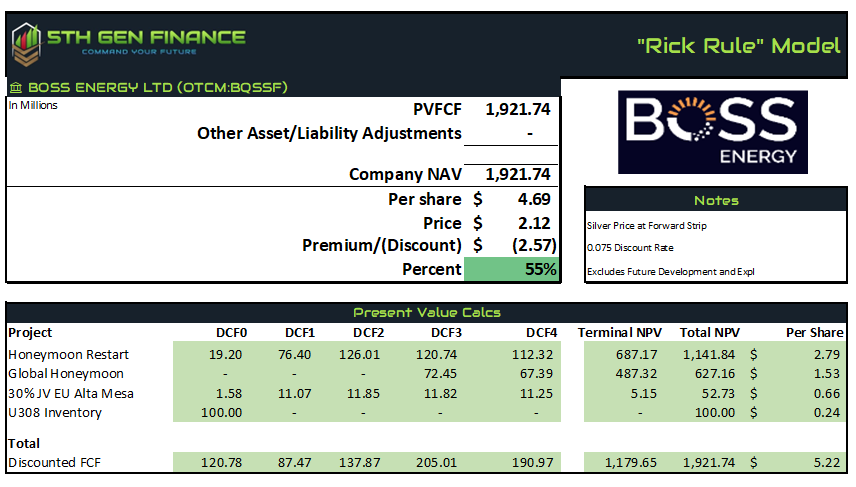

Boss’s assets include its “Honeymoon” mine brownfield restart project which is currently in production and expected to produce 800k lbs next year. In addition there are “Global Honeymoon” projects in the area that the company plans to unlock via ISR (insitu) process. Recently they entered into an agreement for 30% of Encores Alta Mesa asset in exchange for cash and the patent on EU ISR technique.

Forward assumptions include:

7.5% discount rate, consistent with Australian jurisdiction

Excluding asset expansion and exploration

Uranium sales prices at the current forward strip

$35 conservative all in costs for Honeymoon

Company has 200m+ of cash on its balance sheet not reflected here (roughly $.50/sh)

The chart is a bit scary, but it does suggest we may be near the bottom of the most recent correction.

As a value buyer, this has been an opportunity to accumulate in what has been a leading company in the mid tier producer space. Earnings results should continue to improve in terms of cash flow, barring something unforeseen.

Upside Optionality to U308 prices:

This is what our valuation looks like with $150 U308 pricing. The company is a bit more leveraged than EU.

Conclusion (Buy)

We view Boss as an opportunity to accumulate at value at this level. The broad perspective is that the overall market will become bullish mid to late 3Q due to rush of contracting. You will want to have purchased Boss by that time as they will likely be an out-performer with un-contracted pounds to sell into the market or demand higher pricing in there contracting.

…I’ve had less time than I thought to work on these. Only 2 left in part 2 as I will consider the PDN and FCU as a single merged company. To be continued…

**Disclaimer:**

The information and outputs provided by this 5th generation finance model are for informational purposes only and should not be considered financial advice. While the model utilizes advanced techniques, financial markets are inherently complex and subject to unpredictable changes. Following the model's recommendations does not guarantee positive financial outcomes, and there is a possibility of financial loss.

**Important:**

* It is crucial to conduct your own independent research and due diligence before making any financial decisions.

* Consider seeking professional financial advice tailored to your specific circumstances.

* You are solely responsible for the investment decisions you make and the associated risks.