TRADE ALERT! - Newmont Bull Call Setup

$NEM Newmont mining may be giving us a good entry for a powerful options trade! This is about 5/1 risk reward at 8-10x the leverage to gold!

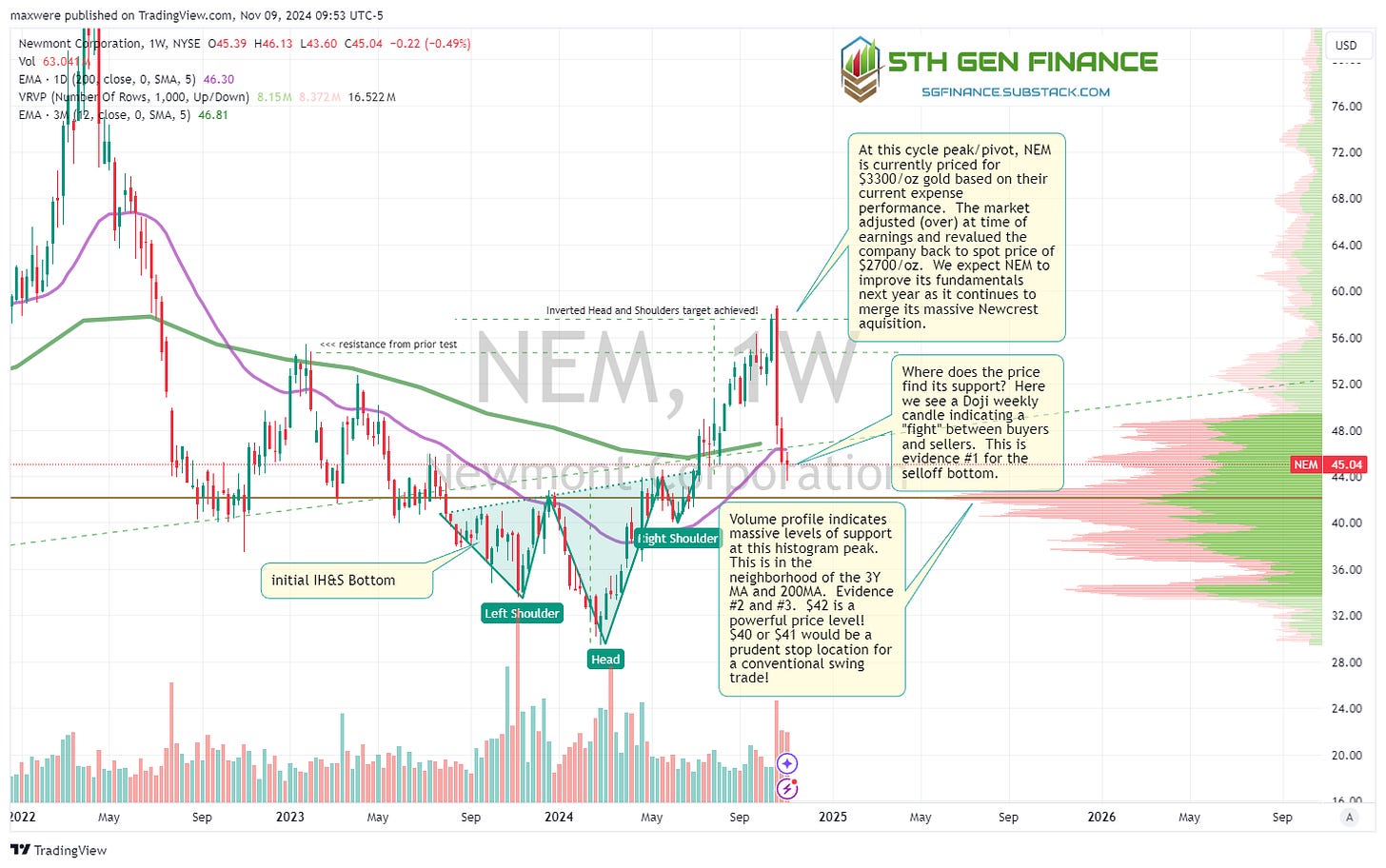

Recently NEM 0.00%↑ reported earnings to the tune of “slightly below forecast” and proceeded to sell off by 13b dollars! This is no small change for a mining company, even the largest gold miner in the world. Why was the selloff so harsh? The answer we are told, was production costs were too high. The truth is, the stock had gotten temporarily expensive, completed very clear patterns and was overdue for a break.

If you’re like me, a huge selloff in a bull market has you asking, is it cheap again?

1. Selloff is nearing its conclusion

The selloff happened with lots of momentum but seems to have lost steam this week.

2. How to play the trade

This section is a options education piece. If you already understand option trades and bull call spread, feel free to skip to section 5 at the end of the document…

There are several ways to trade what we expect is swing back to the high…

Buy the stock outright - This creates a risk reward of 1/2.68. This is attractive asymmetry to the upside and is simple enough to do. Max loss is 11% and max gain is 30%. For the sake of comparison, let’s suppose we bought 100 shares for $4504 based on current price of $45.04

Buy an ITM call option. A call option is the right (not the obligation) to buy a stock at a particular price. “In The Money”, refers to the strike price being lower than the current market price. In The Money call options offer the trader exposure to the movement of the stock without as high of investment of capital as buying the stock outright. For this scenario we will look at a call option with a strike price of $40 (10% lower than current price) and expiration date of 1/16/26. The expiry date is chosen because Jan options have the most market liquidity and I believe the trade will most likely play out in the blue box below. The price of this option is $9 or $900 to control 100 shares.

Buy an “At the Money” call option. Strike price of $45 and expiration of 1/16/26. The price is about $6.40 per contract or initial investment of $640

Bull call spread. Buy an “At the Money” call at $45 strike, sell call at $60 strike for the 1/16/26 expiration. The price of this derivative is around $4.15 or $415.

The max value at expiration is capped at $60-$45 or $15. Options carry with them high premiums that account for the time and volatility of future prices. In the retail world, think of it as a 30-40% markup. We sell a long out of the money call to offset this market. With a “naked” position, your option is losing value every day by simply going sideways. The call spread position allows the price to wander sideways for some time without real cost to the purchaser. In this way, the option spread is like paying wholesale prices!

Not that we have 4 possible ways to play, let’s illustrate the outcomes based on 4 simple, realistic scenarios that could play out.

3. Stops and Targets

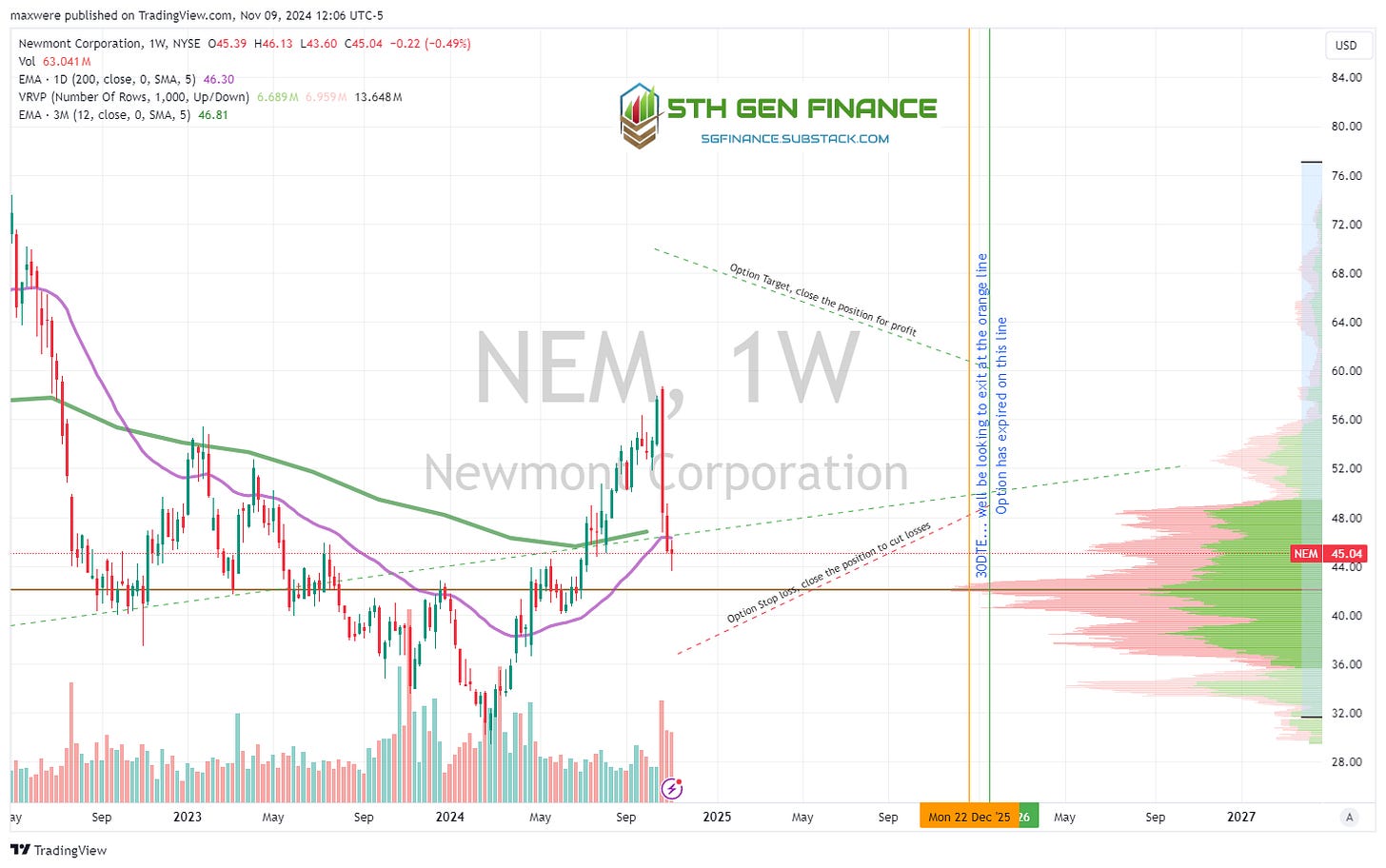

In options trading, you will experience maximum risk and volatility of price as the contract nears expiration. For this reason, we plan to close our positions on or near the 30DTE (days to expiration) horizontal line (orange).

Additionally, due to the way the math works out (law of diminishing returns), the optimal stops and targets present themselves as diagonals over time (option traders call these “surfaces”. Options calculation and forecasting can get to insane levels of useless precision. To stick with the simplicity of this example, we are going to assume the red and green diagonals are the optimal spots to close positions.

4. Four Simple Scenarios and P/L Illustration

green line, bullish. This is what we expect with our setup at this entry point. Base case (40%) probability. Equal weight/risk neutral (25%).

purple, sideways to slightly up. Somewhat of a fizzle, but still profitable. Assume 20% base case and 25% equal weight probabilities.

orange, rollover. 20% base case and 25% equal weight probability

red, breakdown and failure of the pattern. 20% base case and 25% equal weight.

Applying our four “ways to play” we have (Stock purchase, ITM call option, ATM call option and bull call spread):

Base Case (40%,20%,20%,20%)

Equal Weight/RN (25%,25%,25%,25%)

In both cases, note that the spread strategy has the highest expected P/L percentage of all the trade strategies, by a large margin! Perhaps just as importantly, the loss was only the second greatest percent in the worst case scenario! In the best case, we achieved 6x leverage to the upside and only 4.4x to the downside compared to purchasing the stock straight out.

You can clearly see why professional options traders choose a bull call spread when speculating on the price of a stock to move upward!

**if the stock where to go straight upward, the most out of the money call option will always perform the best. Because these “events” are so memorable, we think they happen more than they do (which is almost never).

5. Bull Call Spread Trade Execution

Disclaimer: the underlying price action of the stock makes the price forecast of the derivative somewhat in flux. Since these options are dated out in advance aways thats likely not to be more than +-$.20

Vertical call spread on NEM 0.00%↑ (Newmont Mining). Buy 45 - exp1/16/26 call options and sell 60 - exp1/16/26 call. Limit debit of $4.15.

I will be updating the stops and targets of the management of this trade as I get execution. It will look similar to the chart below:

As we saw in the illustration, if managed according to the plan, max loss should be about 50% of initial investment and max gain 200% of investment. This trade should take the balance of next year to play out. Use this information AND your own experience with options trading to factor an appropriate position size for your portfolio.

**Disclaimer:**

The information and outputs provided by this 5th generation finance model are for informational purposes only and should not be considered financial advice. While the model utilizes advanced techniques, financial markets are inherently complex and subject to unpredictable changes. Following the model's recommendations does not guarantee positive financial outcomes, and there is a possibility of financial loss.

**Important:**

* Options trading carries a high risk of loss of capital. Trade at your own risk

* It is crucial to conduct your own independent research and due diligence before making any financial decisions.

* Consider seeking professional financial advice tailored to your specific circumstances.

* You are solely responsible for the investment decisions you make and the associated risks.

Great post!

update: I plan 2-3 tranches... first one filled at $3.70