Who is SilverCrest Mining?

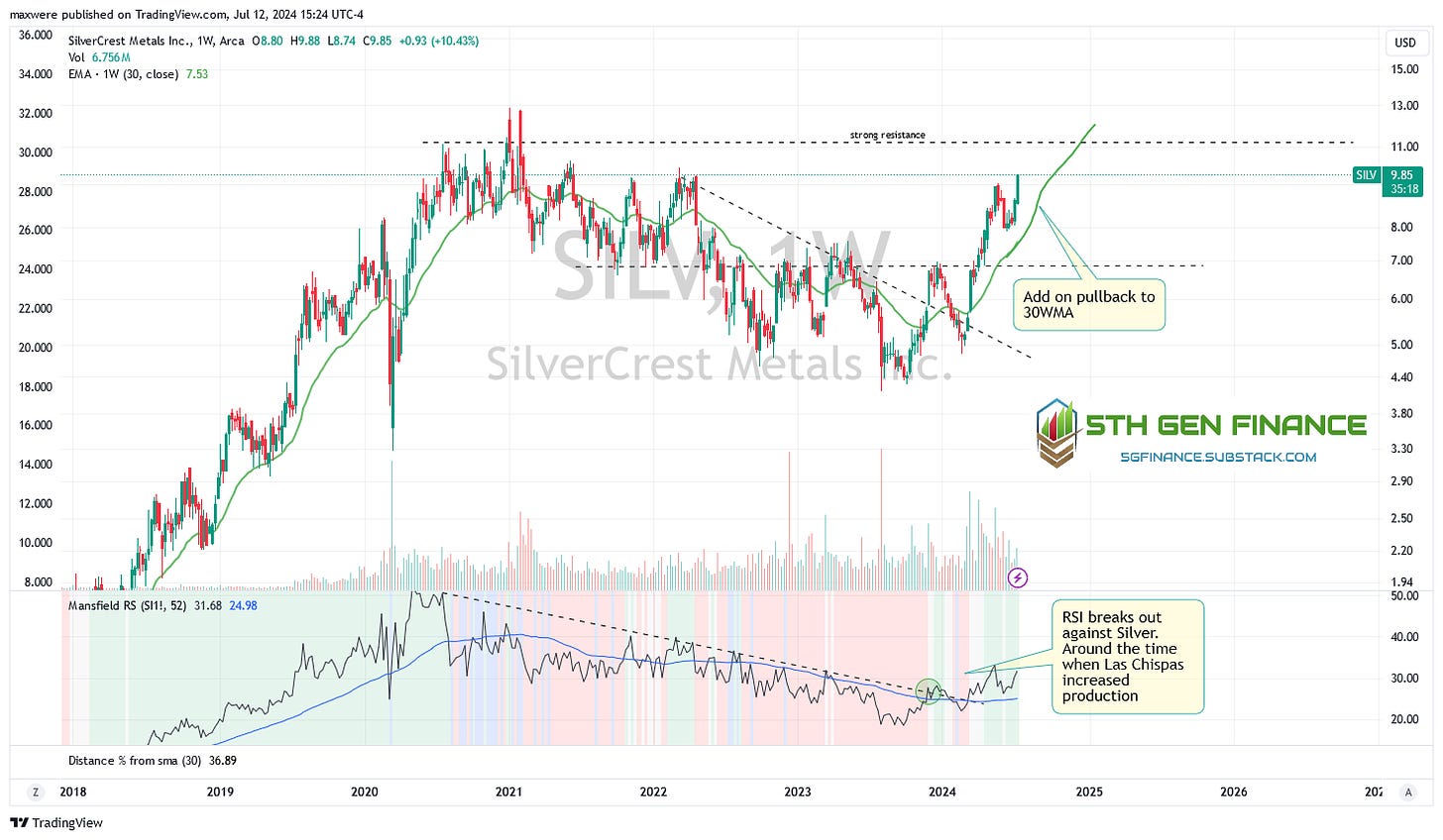

Unfortunately, last year SilverCrest updated their reserves and resources to the downside to the tune of 20 or 30%. This led to a big selloff in the stock. The news has been better since. As of this writing, the company is up nearly 50% off its February lows. With such good short-term performance, is it too late to take a position? Let's look under the hood...

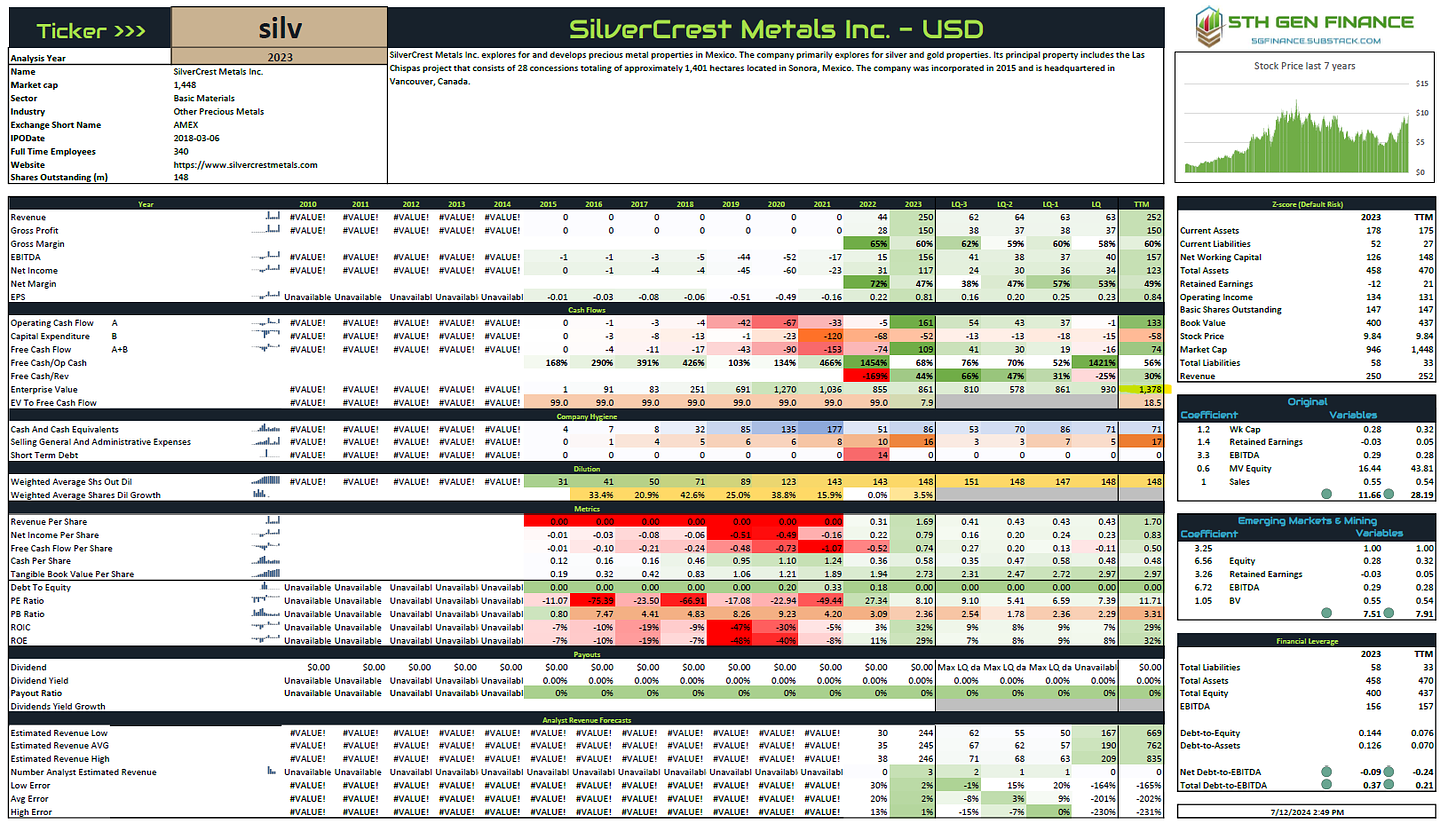

SilverCrest Metals Inc. explores for and develops precious metal properties in Mexico. The company primarily explores for silver and gold properties. Its principal property includes the Las Chispas project that consists of 28 concessions totaling of approximately 1,401 hectares located in Sonora, Mexico. The company was incorporated in 2015 and is headquartered in Vancouver, Canada.

Silver Crest has all three of its assets all in Mexico, the largest and one in production now is Las Chispas. For this analysis, we'll deal entirely in the latter and assume any investor gets the undeveloped projects for free. And who doesn’t love that price?

Las Chispas

Reserves and resources currently 125m oz Ag eq. (This number is expected to improve, but we do not significantly increase our forecast)

Annual production of roughly 10m oz a year. The latest quarterly figure recovered 2.68m Ag equivalent ounces. We believe 10m may be on the low side of realized production.

All in sustaining cost-plus operating cost is roughly $17 with it slightly rising over the next 5 years to accommodate higher energy costs. This is our break even cost per ounce of silver produced. If you are familiar with options, this could be thought of as the strike price of a silver option. (price sensitivity is roughly 2”-3x leverage to the price of silver itself.

Sonora is generally a favorable operational environment, however its correct to assume 100% exposure to any political aims of the Mexican government. There are none on the horizon, but that risk is non-diversified in this sense.

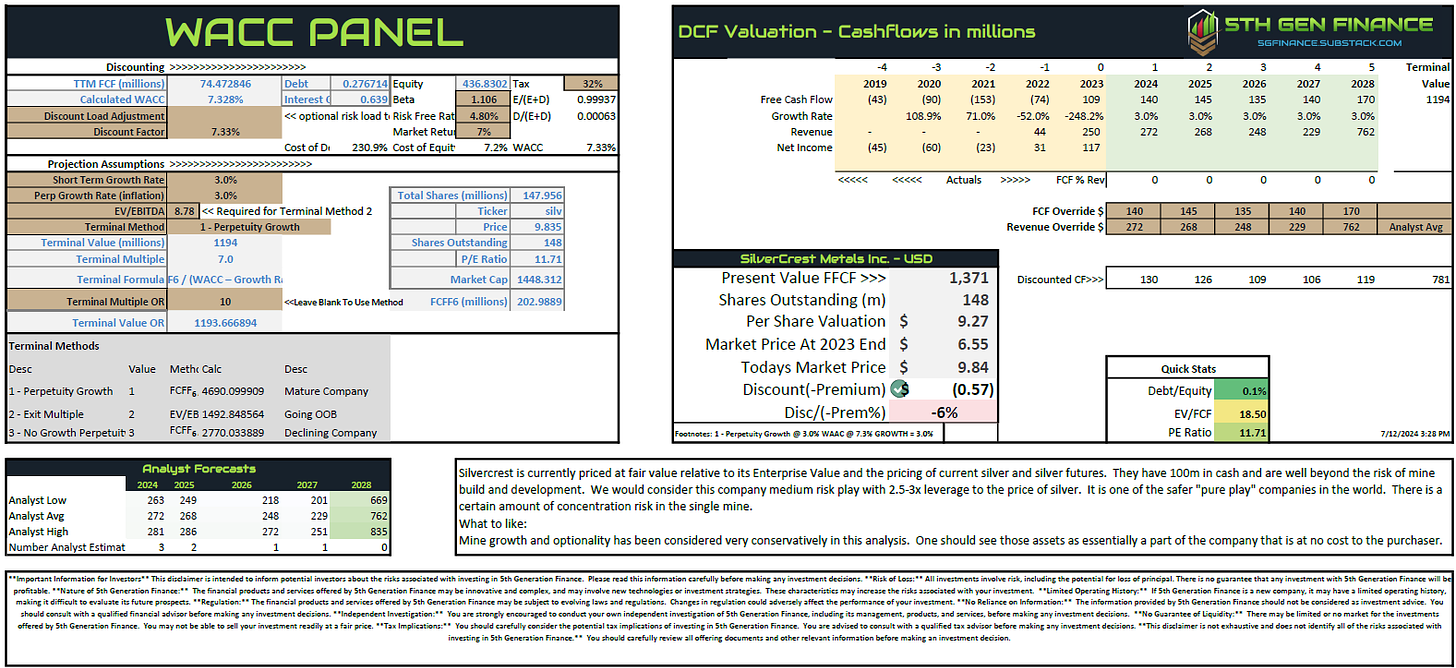

Forecast assumptions include current forward strip of silver, calculated discount of 7.33% (WACC), and a 14 year mine life

The Kitty Model

Not a lot of history to speak of, but 2Q generated revenue of 72m or 15% Q/Q increase. This from an average sale price of $27.84. Silver doesn’t have to do anything from here to garner another 15% increase in 3Q.

Best Estimate Forecast

This forecast is considered “best estimate” based on a forward price of the current silver futures market. If you are buying silver stocks, it probably means you believe the price will be higher that $35 five years from now. That’s not priced in here.

So it’s not expensive, when should I buy (more)?

Hindsight reveals all. The obvious entry now was around $7 on the breakout of the triangle pattern below. That level is the new support. However, I have doubts we will test it again, short of a major pullback by silver to the mid 20s. If you look to the left of the chart, the 30 week moving average has created solid support for “dip buying”. I would be patient and add positions on retest of the moving average. The stock is very “stretched” at the moment.

Second point here, there is overhead resistance at $11 or so. I have a fair degree of confidence this line gets taken out, but it could take a few months and create something of a cup and handle buying opportunity. I’d keep an eye out for this mid fall 2024.

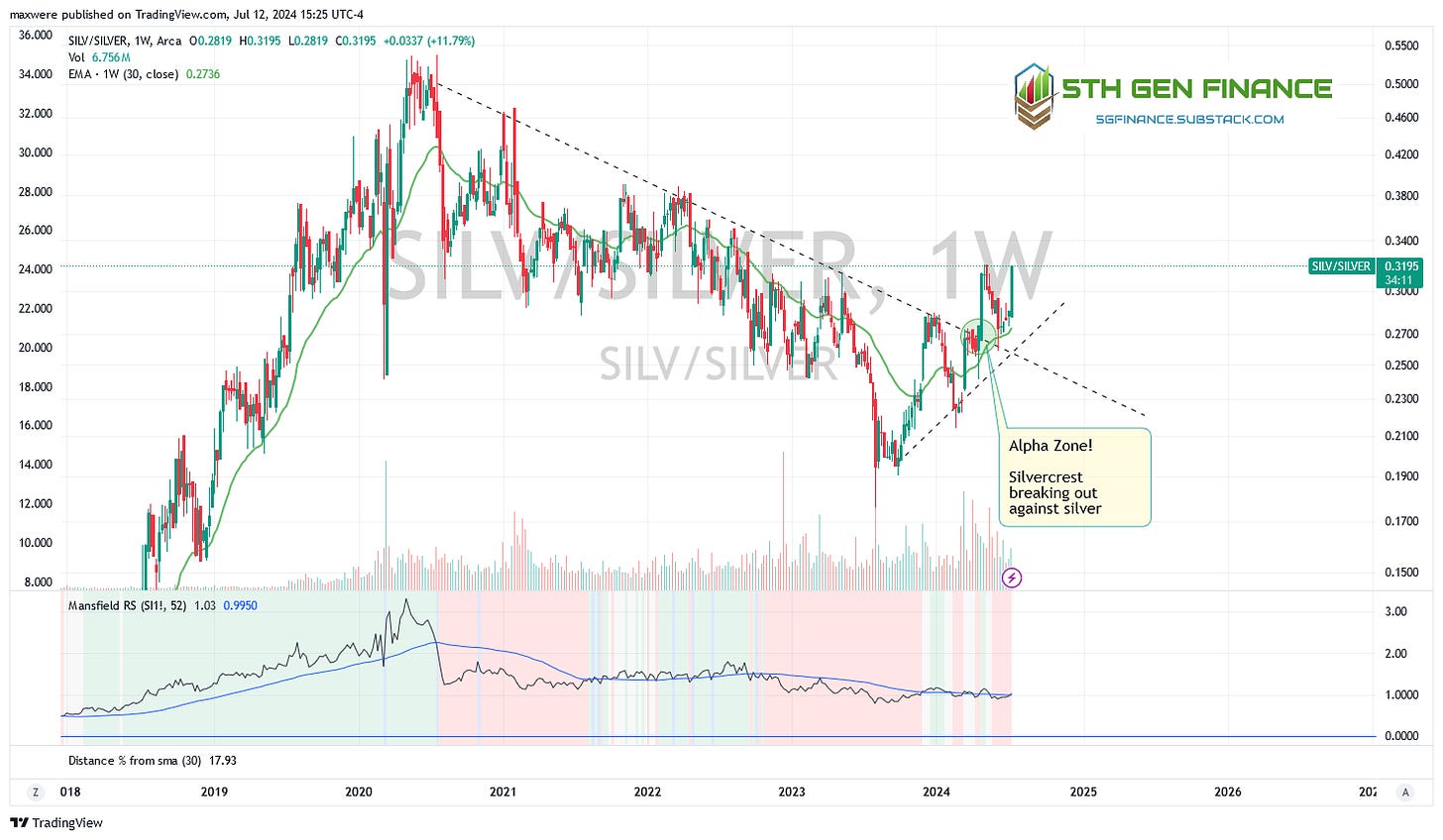

Relative to the metal…

You can see the party started in April 2024. Note the coiling higher low(s) give an indication that the down sloping trend was due to break. This long trend was actually part of a bull flag pattern. A retracement to the lower up trend line or the moving average could also signal an attractive entry point. Maybe its a “sell silver add Silvercrest” strategy for extra torque?

Conclusion

Hold at current. Buy the dips.

This is on the short list of must own silver producers if you want to build a portfolio to reflect pure silver stocks.

**Disclaimer:**

The information and outputs provided by this 5th generation finance model are for informational purposes only and should not be considered financial advice. While the model utilizes advanced techniques, financial markets are inherently complex and subject to unpredictable changes. Following the model's recommendations does not guarantee positive financial outcomes, and there is a possibility of financial loss.

**Important:**

* It is crucial to conduct your own independent research and due diligence before making any financial decisions.

* Consider seeking professional financial advice tailored to your specific circumstances.

* You are solely responsible for the investment decisions you make and the associated risks.