PGMs - Platinum Group Metals: Is it "GO" time?

Are we finally in for that face-melting rally? Lots of evidence, and a prudent way to play it...

What are PGMs?

Why would I (or anyone for that matter) want Platinum or Palladium?

…this is the first investing question you should be asking yourself.

They are precious metals - they have moneyness in terms of collectability and transactability. Dense, portable, identifiable, divisible etc.

They are industrial metals - primarily, auto-catalysts.

They are very rare. Global supply of Platinum is around 6m oz roughly. Annual consumption is nearly that much, so production needs to keep pace or the commodity will squeeze sharply higher

Industrial applications require PGMs (there is no substitute), but generally in small amounts. That is to say, demand isn’t terribly elastic relative to the price of the metal. The cost of a catalytic converter doubling because platinum tripled has very little effect on the sale of cars and trucks!

What is the current price setup for the metal?

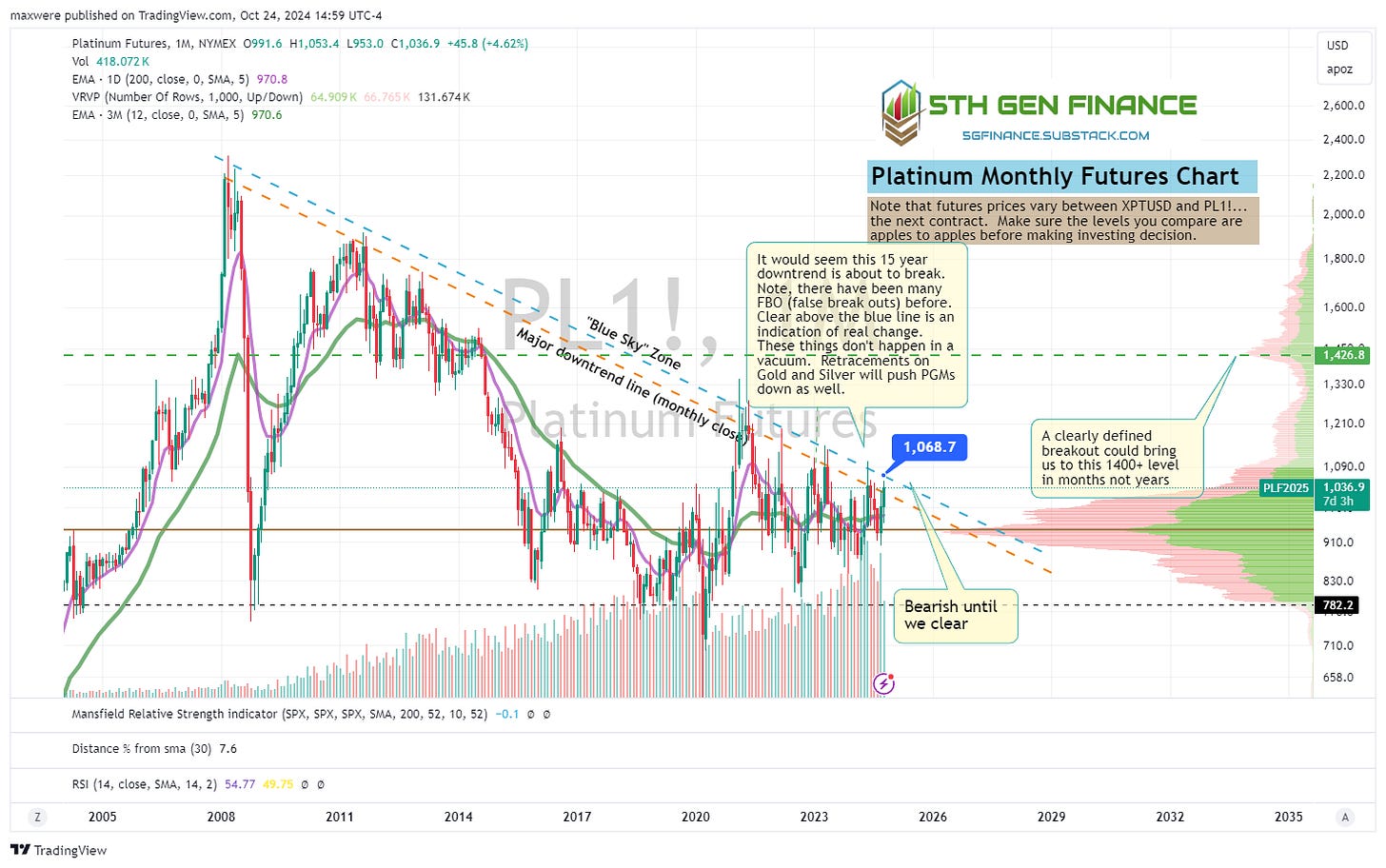

Platinum Futures:

First things first, PGM futures prices have enormous volatility, even at high time frames. A breakout isn’t a microscopic artifact on the chart, only you can see. It should be clear to the market and other investors. You will see countless wicks that muddy up the triangle pattern in the platinum chart below. This creates a bit of a zone, not a single line of resistance.

Be patient that the zone is confirmed. Resist the rush to get in!

Palladium Futures:

As of recent times, palladium was the dominant input for auto-cats. While this trend is slated to revert to platinum, there’s no reason to suggest palladium is dead.

As of this writing, we saw an overnight spike of 7% or so. The result of this is a double bottom and perhaps a breakout (yet to be confirmed).

Zooming in to Palladium… there is a nice RSI reversal in play on the weekly chart. With expanding bottom, it looks as if this is a real possible breakout:

Physical Trusts Charts

SPPP - Sprott physical platinum and palladium. This trust is made up of roughly 55/45 palladium to platinum. Physical. Deliverable. Highly recommended, second only to holding the stuff in a safe.

The chart morphs a classic double bottom pattern with RSI bearish divergence. Above the 3-year MA, high volume breakout. If you ignore all the other evidence on this page, there is plenty enough on this single chart to take a trade (stops 8.50, target 13.50). I think $10.70 is a fine price provided we get confirmation close on 10/25.

GraniteShares PLTM - Platinum Trust

Similar to the Sprott fund, this trust has lower liquidity. Use limit orders only. The chart is very similar to platinum futures. I think the futures chart contains the buy signal. In particular, we are looking for a close above $10.20 or so.

Individual Stock Charts

Anglo American Platinum looks very primed for a bullish move. Once the Mansfield RSI at the bottom turns green (perhaps next week) we have a very strong set of signals. Upward sloping RSI suggests firm stage 1 base, ready for a break out.

Impala Platinum - Has the strongest looking chart of the 3 major producers at the moment. I don’t think I will wait for a strong pullback to add more to my position.

The US ticker IMPUY is generally available everywhere stocks are sold:

Sibanye Stillwater - SBSW

We look to end stage 4 decline here, but given the other evidence, a breakout and stage 2 run might not be far away. In keeping with the other two stocks above, these companies can be held in sideways markets because the generate a lot of cash and pay high dividend payouts of 7-9%!

Building a portfolio: How can I “play” the potential move in PGM prices?

Given that these stocks are generally coming out of a stage 4 decline, it’s sensible that the commodity may outperform in the earliest era of the run. For this reason, I suggest constructing a portfolio of physical trust and common or OTC stocks.

For the ease of divisibility, assume you have $12,000 invest-able dollars in the PGM sector. Keep in mind, this sector with the physical metal and very large companies can still rival the volatility of Uranium and wild silver stocks. Use prudence when apportioning position size.

To initially build the portfolio we might invest 50% in the real asset and 50%/3 in each of the major producers. That initial portfolio looks like the following:

SPPP: 6k (call this 4.5 oz of plat and palladium)

ANGPY, IMPUY and SBSW: 2k each.

Investor Prudence: At the very worst possible scenario, the companies file chapter 7 and you have 4.5 oz of a precious metal. Not likely worth 12k at that moment, but you have 4.5 oz of a valuable asset, in the worst-case scenario! (assuming you didn’t plan sell stops)

At this point, you’ll want to keep an eye on the ratio charts. Below I picture Anglo/SPPP. The chart looks very constructive, but even so, it could stay sideways for some time.

As the chart affirms the stage 2 bull market, you are likely to see this chart do something like what is depicted in the green arrow below:

As the ratio charts reverse, you can throttle the torque in your portfolio toward risk and better risk adjusted returns! All-the-while, not missing out on the move of the commodity!

Unsolicited plug: If you like this sector and investment thesis, follow Uselink over on his substack. He’s updating platinum weekly and covering the entire sector! Link below. Cheers!

**Disclaimer:**

The information and outputs provided by this 5th generation finance model are for informational purposes only and should not be considered financial advice. While the model utilizes advanced techniques, financial markets are inherently complex and subject to unpredictable changes. Following the model's recommendations does not guarantee positive financial outcomes, and there is a possibility of financial loss.

**Important:**

* It is crucial to conduct your own independent research and due diligence before making any financial decisions.

* Consider seeking professional financial advice tailored to your specific circumstances.

* You are solely responsible for the investment decisions you make and the associated risks.

This has been a bummer so far. I think we FBO'd back into stage 1 accumulation. Not a big frustration since SBSW and other companies are reporting positive earnings at current conditions. Hold your fire on the juniors though.