Is NuScale the new Gamestop?

$SMR has become an explosive stock these days. What is up with $SMR and is it time to sell? Lets take a deeper dive.

Technology always gets overbought, anywhere and everywhere. The reality is that the future offers solutions to energy issues that ARE green and DON’T involve wind and solar. NuScale power is one manufacture that has a real chance of delivering the technology, but that chance is not 99%.

The Positives

NuScale is the only US DoE SMR design that is approved (so far). They have the inside track

If they were to emerge as 20% global market share of future SMR (a realistic possibility given the players and their current design). The company is absurdly cheap at 2B market cap. If NVDA and BTC are worth 2T, surely SMR technology is worth 10% of that just in its ability to service those applications alone. That simply valuation puts SMR (several big IFs) at 40B or 20x its current market price. On a relative basis, its still cheap as technology goes.

NuScale stands to benefit from a bullish green energy thesis, bullish uranium thesis, bullish AI and Crypto thesis.

Last year a single hedge fund actively promoted what some might call a trash and cash scheme that created large percent of short positions creating an oversold situation at $3 or so.

They were award financial assistance from the DoE.

There is a new agreement in the works with a South Korean company to support datacenter: https://neutronbytes.com/2024/05/27/nuscale-reported-to-ink-a-1-5-billion-reactor-equipment-deal-with-south-koreas-doosan-enerbility-to-build-smrs-for-two-us-data-centers/

The Negatives

Unlike $NVDA, $SMR is burning cash relatively quickly. …the tune of 150m/year quickly. That’s a dilutive trend.

Utah power systems contract (UAMPS) fell through last year.

There was a potential contract with Romania, but hasn’t been solidified.

There was another supposed contract in the works around crypto mining/data center/AI industry as I recall, but it is questionable in terms of funding and viability: https://www.utilitydive.com/news/nuscale-small-modular-reactor-smr-data-center-nuclear/710442/

Fundamental Conclusion

I DON’T KNOW. There simply isn’t any real tangible business cash flow to create any kind of actionable proforma. This seems like an intellectual property play. Which, it that’s your game, you can probably find warrants (SMR/W).

As a pure fundamental analyst, that’s the end of it. Sell. DON’T buy. But, I’m not a pure fundamentalist…

Technical Analysis

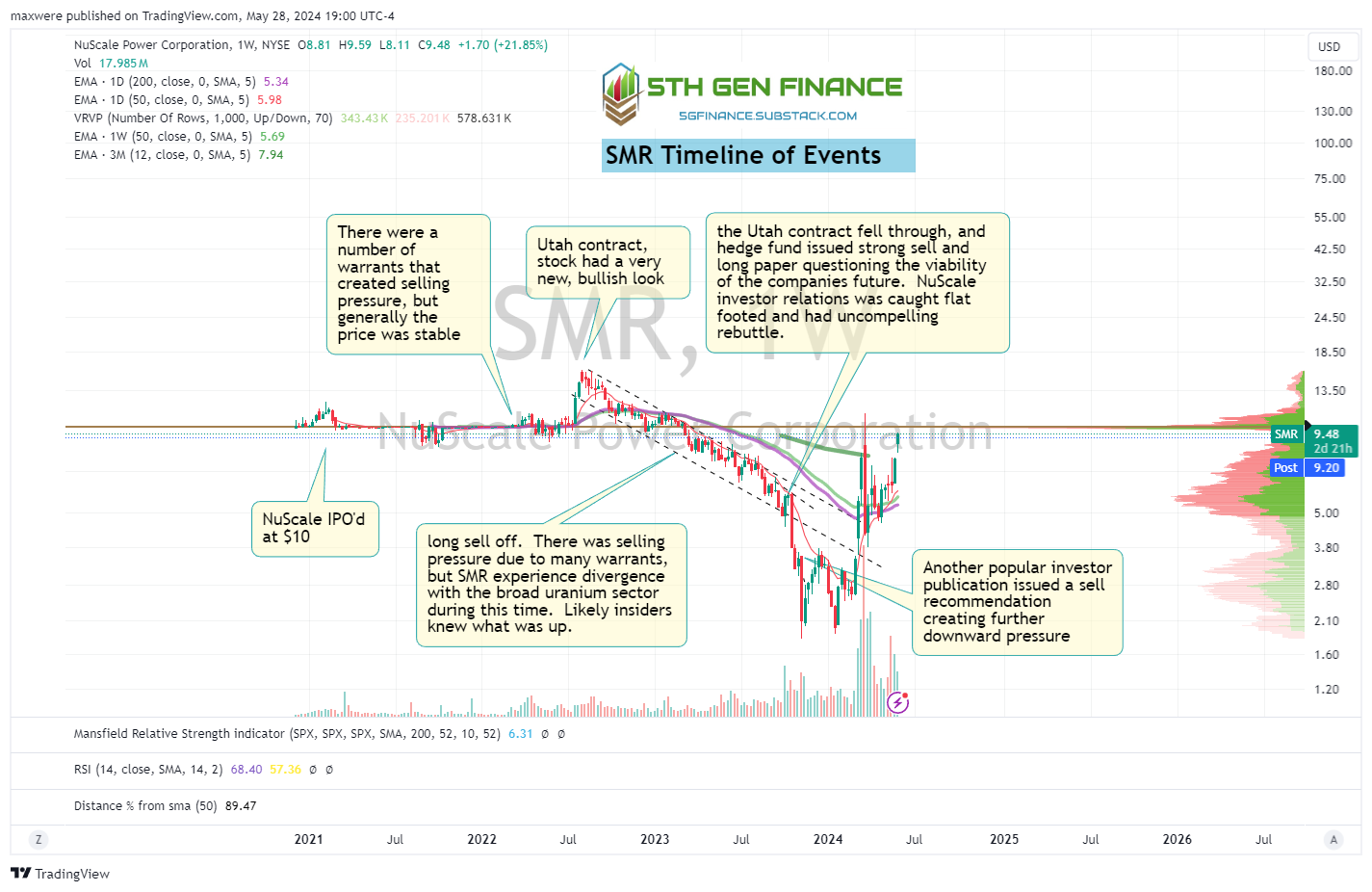

Firstly, the most recent swing trade setups we’re really on the daily chart (a chart I don’t often follow closely). The rough timeline of events described above as overview of the price action can be seen on this chart:

I must disclose, I was a sharehold from the point of IPO. I did what all the worst, most inexperienced shareholders do. I rode out the dip, then unloading half of my position for a small profit during the March blow off. I repurchased some back at cost basis around $7.50. The market has been generous of late and frankly I’m a bit over positioned. How can I take advantage of the recent price action, yet maintain some exposure to the potential extreme upside of this companies success?

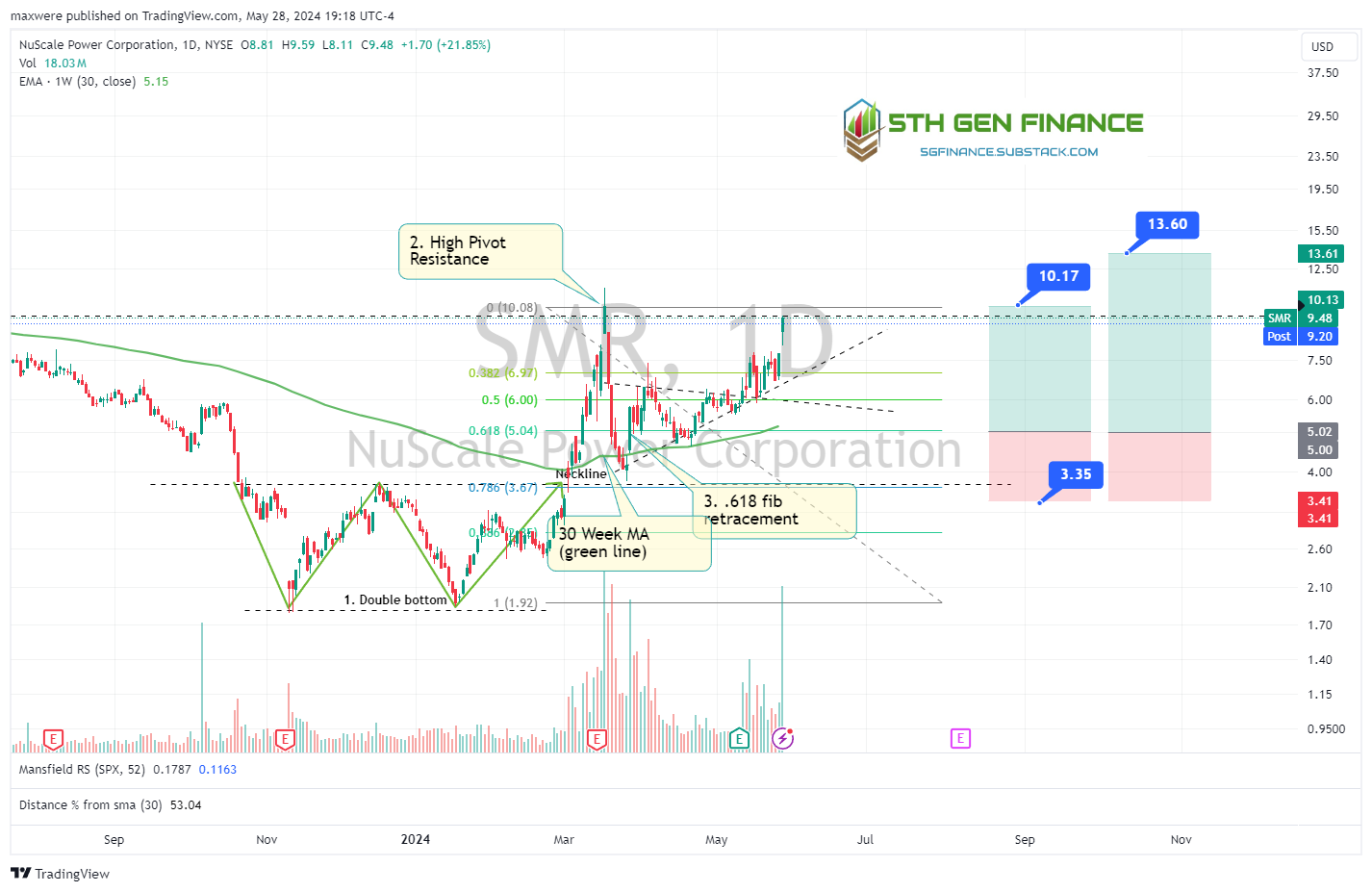

It was this initial thought that brought me to the daily chart which I had ignored. That’s when I saw it. This is a 2618 harmonic pattern that’s in my FOREX trade plan (which I am not currently running)! 2618 bearish pattern is described here.

Pattern confirms when:

clear double bottom (or top) is defined (check)

neck line is broken (check)

high pivot is formed (check)

and .618 retracement of the leg from double bottom to high pivot has completed (check)

a confimed bottom (long wicking candle with follow on green bar in this case… check)

Entry would have been around $5 with non greedy target of $10ish and extended target of $13.60

…ah it would have been a nice one, wouldn’t it have?

That being said I have something actionable as profit targets. I can now set my alerts and de-risk this investment.

An Example…

For the sake of how I will play this, lets assume I have 300 shares with a cost basis of $9. I will sell 100 at each of the profit targets and retain 100 for exposure to the potential upside outlined in the first section. Let’s assume the best case here that both my targets are hit and I sell 200 shares and keep 100.

300 x $9 = $2700 total invested

Sold 100 x $10 + 100 x $13.60 for a total of $2360

That leaves $2700 - $2360 = $340 of the initial investment still invested in SMR. This is now a cost basis of $3.40/share with stock price north of $13. If volatility is any guide the stock could see another wild retracement to $7-8. I would hardly lose sleep. This is the psychology of money management.

Conclusion

Thank goodness for TA!