Imaging Richard Wyckoff's "Composite Man"

Though the technocrats would have you believe its machinery …all the fluctuations in the market and in all the various stocks should be studied as if they were the result of one man’s operations.

“…all the fluctuations in the market and in all the various stocks should be studied as if they were the result of one man’s operations. Let us call him the Composite Man, who, in theory, sits behind the scenes and manipulates the stocks to your disadvantage if you do not understand the game as he plays it; and to your great profit if you do understand it.” (The Richard D. Wyckoff Course in Stock Market Science and Technique, section 9, p. 1-2)

This is Walter. His goal in life is to separate you and everyone else from their money. He will stop and nothing to achieve this goal. Walter has control over the market, the media and the apps you use for entertainment and business. He works 24 hours a day at his task. He's not your friend. A rational, disciplined person learns to recognize and ignore Walter. It takes years, though.

Walter is buying stocks and bonds. Walter is selling futures and prosperity. Exactly what are stocks, bonds, futures or other instruments that are traded in markets?

The price of any asset is determined by the agreement of auctioning sellers and buyers in the market. These are called market makers. Once a price is agreed upon, a trade is executed and Walter updates your screen to reflect. He likes green and red. He likes tickers. You'll be surely be amused… unless its red. Walter doesn't really care if you understand how it works. (Actually, he’d prefer you didn’t.) But, this whole scheme can be described as a supply of the asset versus the demand for that asset. In the case of stocks the asset is the ownership share of the company.

Why would a (rational) person desire an ownership share of a company or other claim:

Future revenue sharing through dividend payment, coupon, interest or profit share.

Speculation that demand for the share will increase over time.

What factors increase/decrease demand?

Money - an increase in supply relative to the asset available in the market. After all, to “buy” requires capital. To “buy” lots, requires lots of capital. Walter has lots of capital. He has even more computers that can represent bidders giving the illusion that there are many buyers or sellers lined up. He prefers to do his work at night or after hours when its only other computers making decisions. He'll no doubt have good news for you in the morning. The more money in a market, the easier it is for Walter to unload his truckloads of product (shares) as the price gets too high. If Walter is going to play the stock you own, he’ll need to inject lots of money into it.

Momentum - No other asset metric attracts more investors that a fast move in price, particularly volatile ones. Retail investors and those who pay little attention to day to day market information glaze over at a 15% daily move in a single stock. Walter loves volatility. Volatility means more commission for Walter. Volatility means you will buy when the price is way too high and sell when its low. You become his buyer when he needs one and his seller when he wants to acquire. You're his friend.

Sentiment - In short, investor psychology. Sentiment is primarily orchestrated by Walter's propaganda. Walter runs the media and designs the apps, tools and advertising to keep you in his game. Buy, buy, buy… that’s Walter talking. Get out! …also Walter.

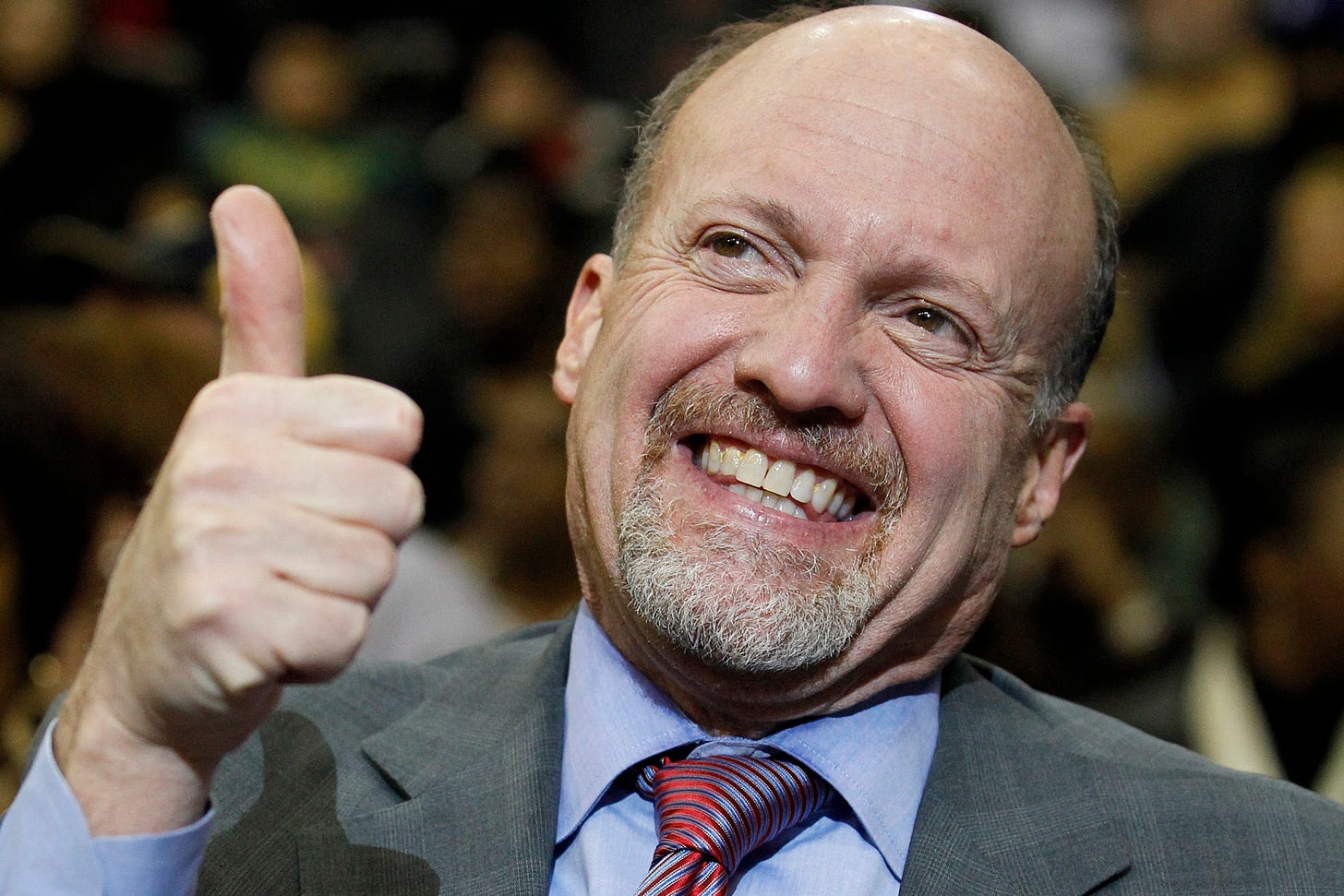

Walter has a team of people working for him. You don' know Walter. You've never seen his picture. But you know who THEY are…

For more on the Wyckoff’s “Composite Man”, accumulation and distribution cycles check out this article: https://school.stockcharts.com/doku.php?id=market_analysis:the_wyckoff_method

Don’t play Walter, you can’t beat him. Learn Walters game and play as if you were Walter.