Apogee achieved. That’s the word of the week, right?

Gold is likely going experience gravitational forces in the near future. By virtually every measurement, there is strong overhead resistance near $3400.

Where does gravity bring us back to? Likely somewhere between $2700 and $3000. That’s a 10-20% retracement. In the weekly chart below, a pullback to $2900 would be no cause for alarm. There really isn’t a reason to see it as anything but a buying opportunity.

Gold versus SPX

Harvesting Gains

The following were trims for me this week:

Kinross - I have KGC at fair value based on today’s current price. With the expectation of gold pulling back, this stock is sure to bounce off the overhead channel. Position closed.

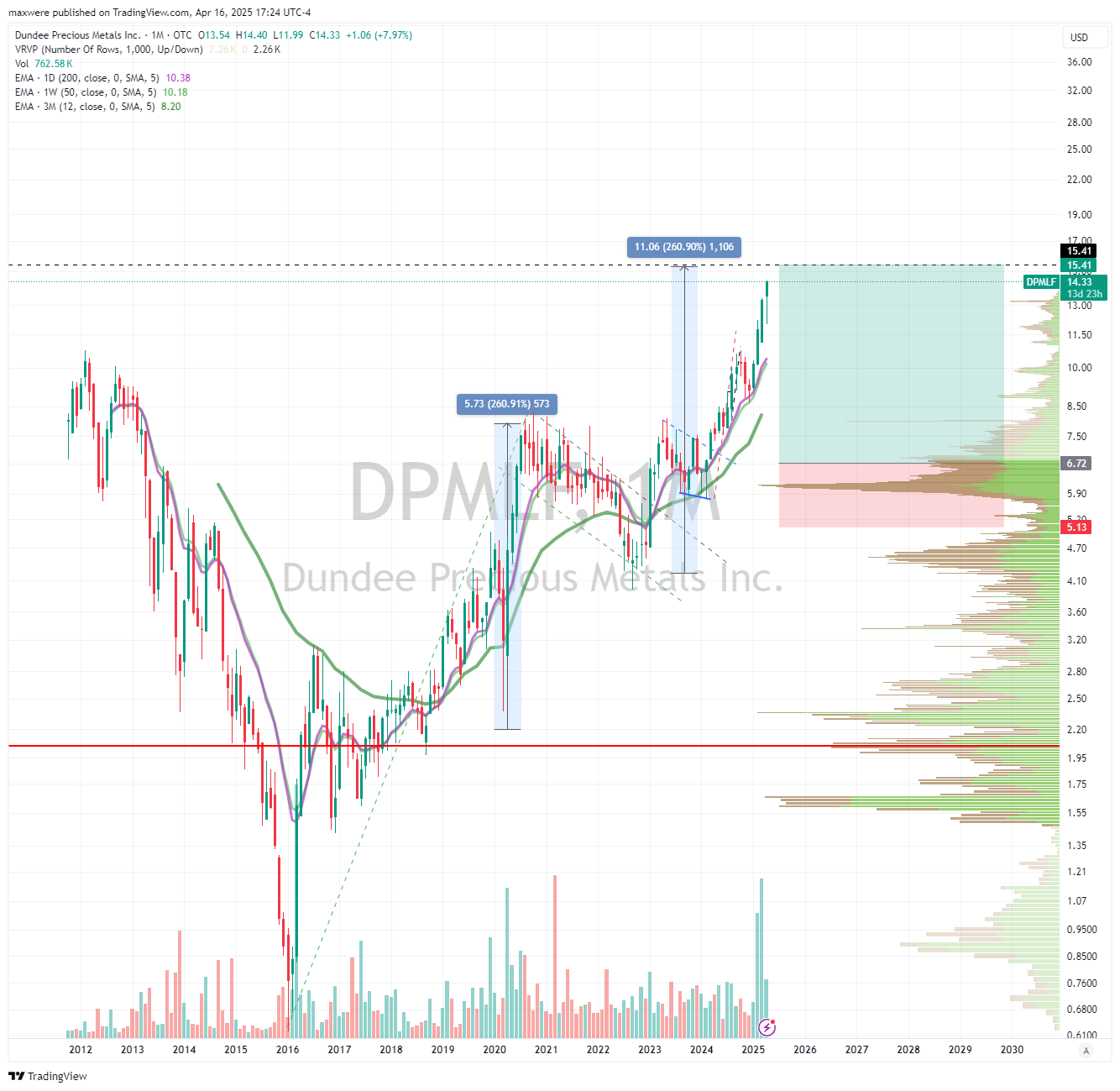

Dundee - I have a fairly greedy price target of $15.41. Close enough to trim the position. Sell half.

DRD gold - this is a tailings pile. There is reason to believe the stock could carry $30 with a continuing higher gold price. Instinctively, I believe SBSW 0.00%↑ will liquidate some shares (they own half the company) at this overhead resistance of $17. Look for a 30% or more pullback for re-entry. Position closed.

Discovery Silver - short term target achieved. Just a massive run. Closed half a position. I think this company is a take out. Most likely a large player, well know for open pit development, will purchase this asset. That may limit its upside on the stock alone. I wrote about this last year. You’re making close to 200% if you entered then.

Regis - RRL.ASX. I wrote a piece on this last year. The answer, of course, was yes.

Regis is close to at least closing half the position. I anticipate a pullback and nice reentry on this stock as well. 150% gain if you entered on my article.