There is a myth among investors that gold price trades in inverse fashion to bond yields. Under this theory Gold and Treasury securities are both considered competing "risk off" assets. So long as both are considered truly risk-free assets, the one with the highest yield is preferred. Since gold's yield is 0 (unless you are lending your gold), that’s typically treasuries. That's a finance paradigm… under normal conditions.

Long Term View

The long-,term view collapses this myth. It’s a fair conclusion that gold is neither positively or negatively correlated with bond prices at all (in the long term). If anything the BIG moves for gold occurred in rising rate environments.

Why Is This?

Let's start with bond fundamentals. The price of a bond is determined by the following:

Relax, all you really need to know is where "r" is in the formula. If r (rates) is moving up, bond values are moving down.

Human reaction to falling prices elicits two possible responses of interest.

Value: The thing I desire is on sale! (implied product credit quality is maintained)

Panic: The thing I own a lot of is collapsing! (implied credit quality is dropping)

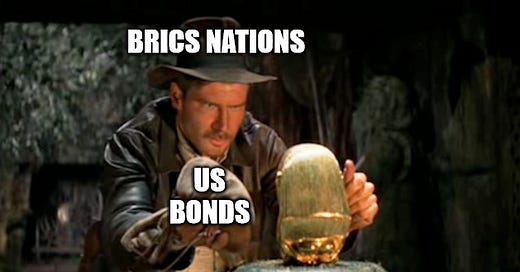

So long as the first sentiment holds true, market participants will generally sell their gold to obtain higher income producing bonds. The gold price falls when yields rise. However, if there are overall credit concerns in the treasury market (e.g. bonds will continue to fall over the long term), investors may actually sell their bonds for more gold. We could also think of this as a momentum trade by speculators.

The Lesson

We naturally run to the nearest Costco to get a newly discounted TV for 20% off, but when that same TV stashed in the back of a dusty clearance store for 50% off, we hesitate to buy. Why? The answer is trust (credit). Too much price momentum and beget more momentum. This is the natural response to stocks like $GME, but for this sentiment to occur in UST market, it should all give us pause.

You can pay too much for something, but you can also pay too little.

Human reasoning develops short cuts to help us deal with concepts that are too difficult to grasp or possibly we simply don't want to sit down and work it out. These are called "Heuristics". Finance is full of such things that are functionally true for long periods of time, until they aren't.

Always test your assumptions about market theory and price. The truth is, there is a lot of propaganda to lure you into paying premiums for portfolio strategies that fit your heuristics. Investment management is a constant process of testing and checking your bias. Incidentally, this is a foundational assumption as to why you shouldn't let AI become your investment advisor. But that is an article for another day…