FOMO Arigato Mr Roboto?

On forming a grounded view on the most talked about disruption of our time.

Broad Thesis…

In my view, the USD is not money. It is a promise to pay (IOU) backed by global oil markets and the full faith and credit of the US government, its global military enforcement (primarily the global coast guard AKA the US Navy). The world is in process of removing the word global from the prior sentence.

Similarly, BTC is not money. It is a share stake of a potential future network ledger that can globally enforce sound weights and measures without the need for a trade agreement (militarily enforced), a treaty or a global coast guard. There are many global sub hegemonies currently in power who experience a net loss in power if this technology were to come to the fore in the form of wide adoption.

Also in my view, BTC is the leading network solution to the clearing of global financial markets (particularly among participants who aren't necessarily of allied states). It seems highly likely that this network will be widely adopted to fill the void of the disintegrating Opec petro-dollar system. If this scenario plays out, it's very likely BTC would be worth more than 500k a coin. But, it make take some time to fully mature. Position sizing should reflect a bet on what the asset could do, not what it is doing. It's almost entirely what an option trader would call, "out of the money". A 1% allocation of net worth at current levels would be more than enough to protect purchasing power disruption from this adoption.

Digital or other metaphysical representations of the physical world will never subsume it. Physical delivery will always be required because human beings have physical requirements and needs. For this reason, the future likely ties a blockchain based network derivative (most likely BTC) to the physical goods markets. Debt monetization of nation states will come under great constraint in this scenario and the burden of debts will incur much higher costs.

Recent News…

That being said, lets ponder the most recent (impressive) move in BTC price action…

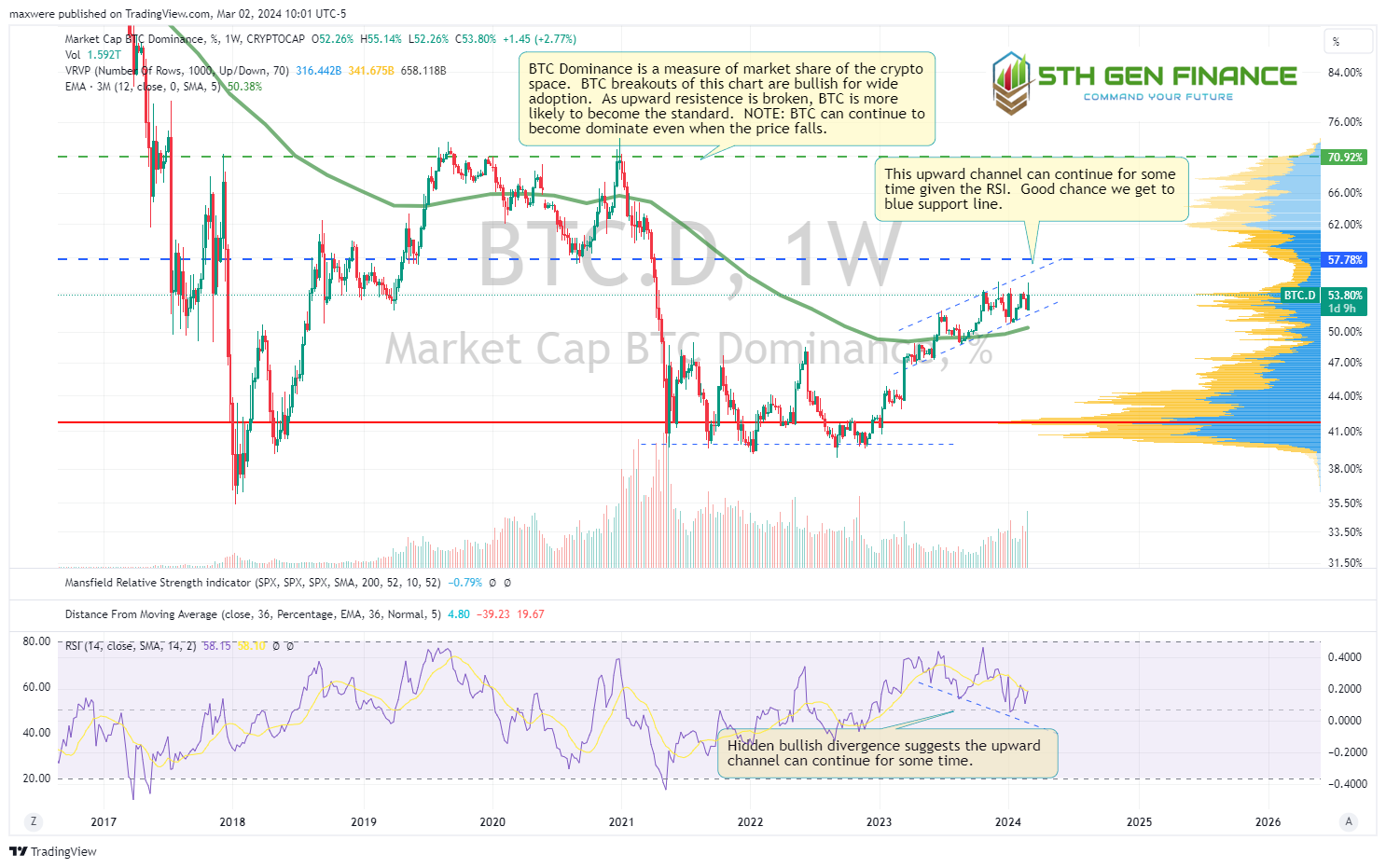

Evidence that BTC is gaining market share relative to other cryptocurrencies. This is positive for the longer term thesis stated above.

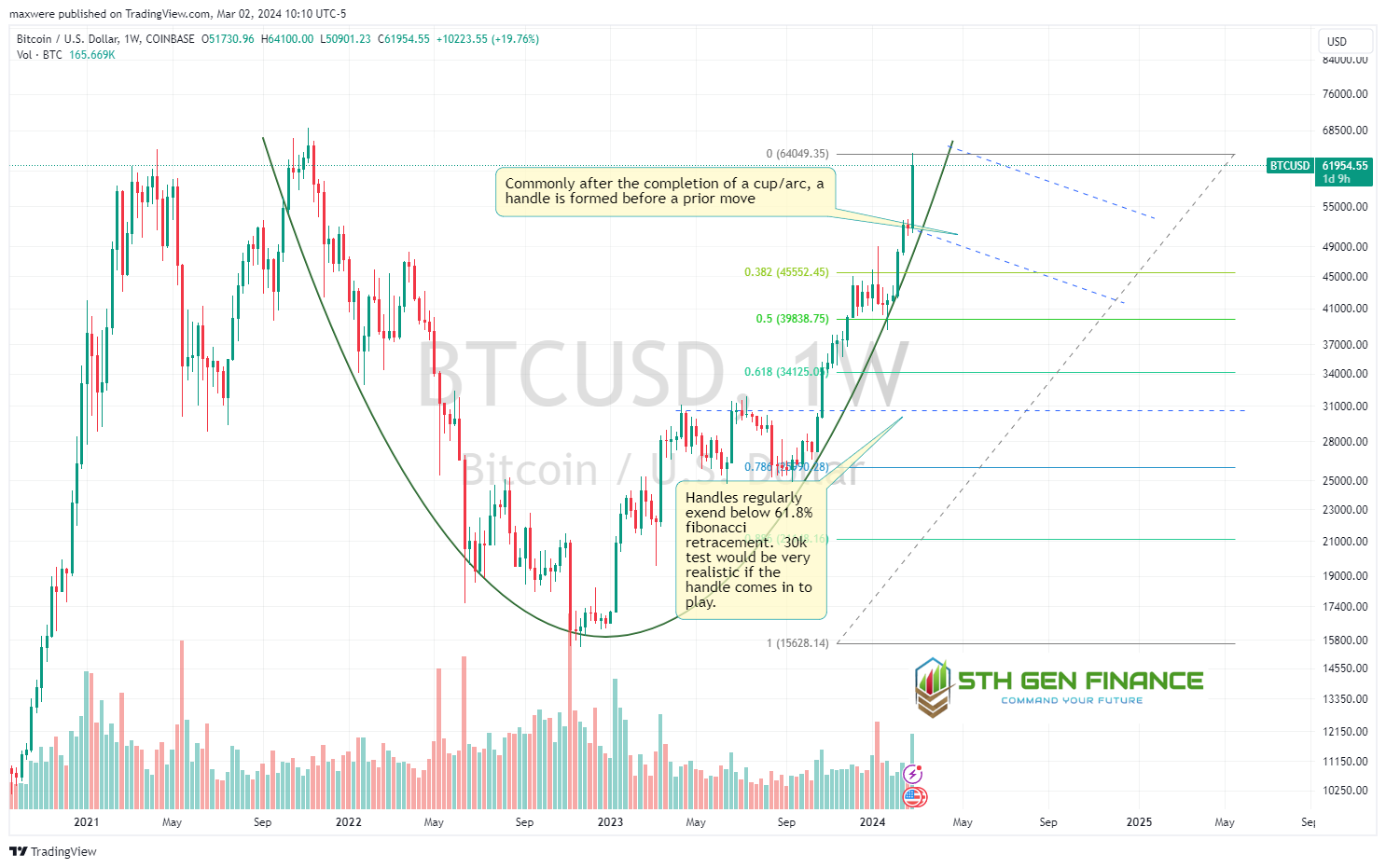

Given the climb and test of near highs and the arc formation, we should consider a handle consolidation is in play in the coming weeks. The bearish, more conservative view is pictured here:

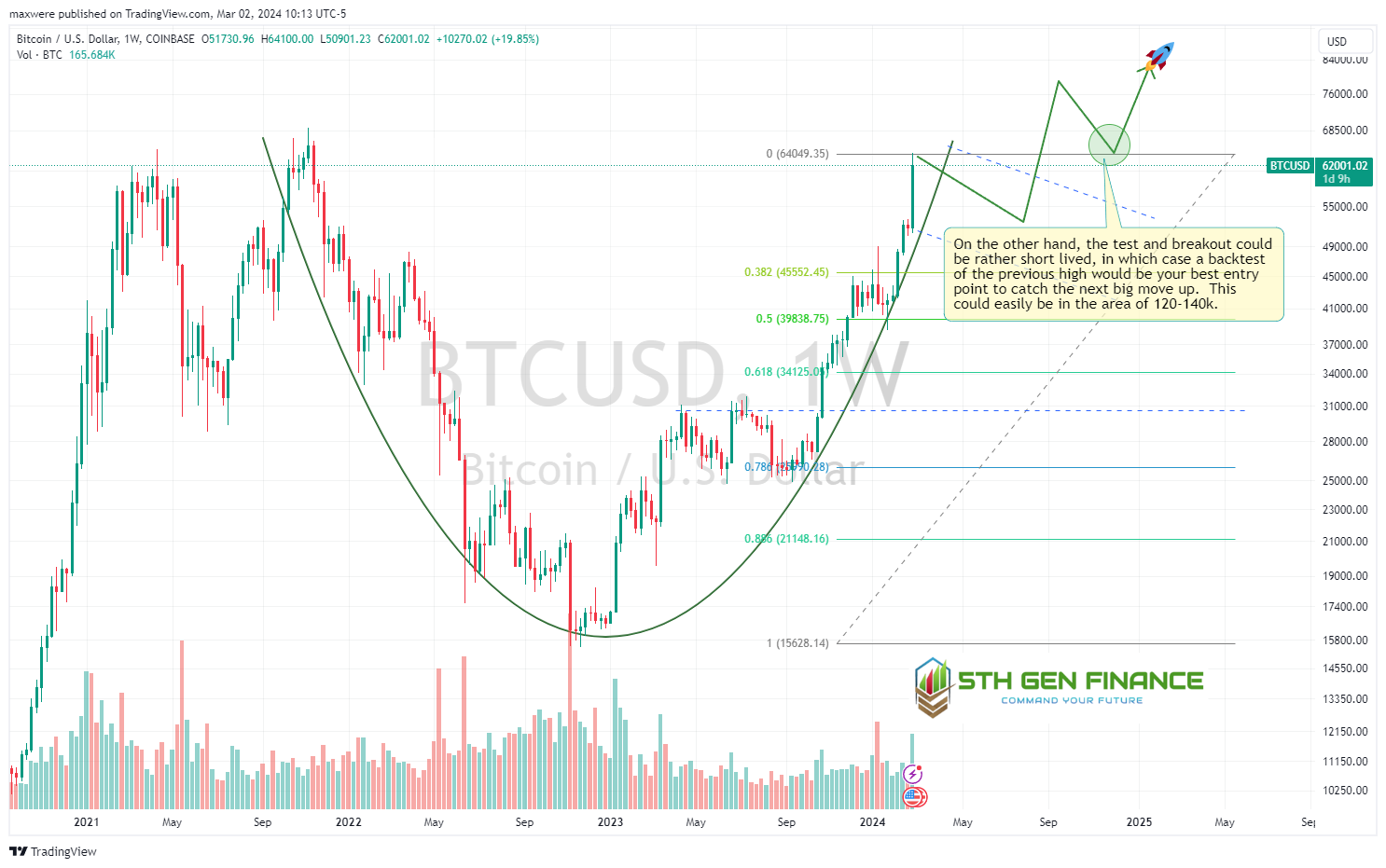

The bullish, more aggressive view is here. In either case, any new money should observe the price action for best entry. On a breakout in the short term it would be the green circle.

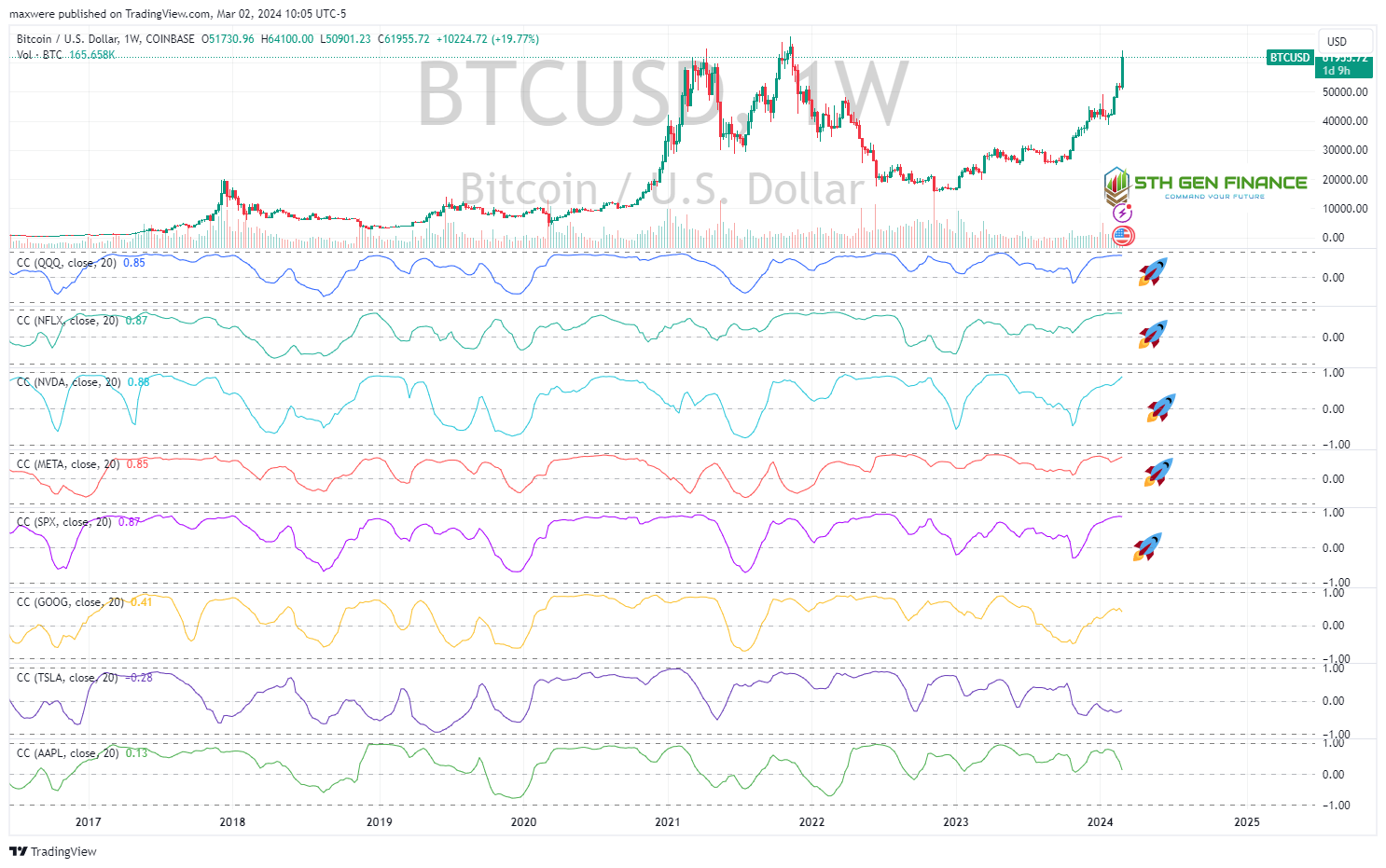

Tap the breaks. BTC has been 90% correlated with the top 5 performing stocks over the course of this bull run. That suggests that as an investable asset its considered a technology play at the moment. Notice Tesla was nearly 100% correlated during the last bull cycle and Tesla has diverged due to emerging competition and the auto recession. Apple is currently diverging. BUT in the case of Tesla, it tracked BTC on the way down as well as the way up. Any bearish conviction toward NVDA, or the AI trade should be factored into your BTC entry at this stage.

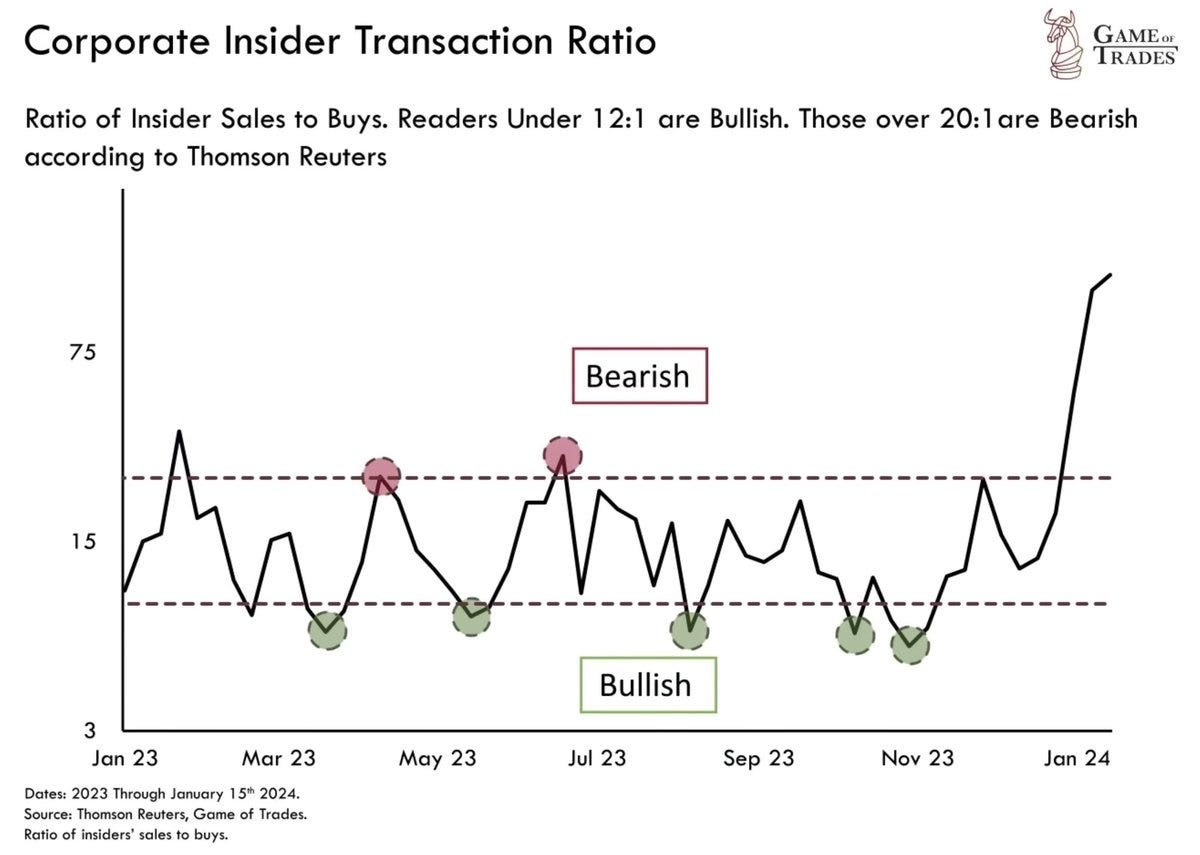

Hand on the emergency brake. Insider trading (smart money) is literally off the charts with broad markets. Recall Elon sold quite a bit of TSLA at the top of its cycle. Proceed wisely and carefully here. A steep broad market correction will create a correction in BTC of the likes of at least scenario in bullet #2.

Lyn Alden has recently completed a fantastic and most comprehensive book on the subject, “Broken Money”. This is a must own, must read for anyone even thinking of putting their money into BTC long term: https://a.co/d/2EH7o4Q